Macro Update

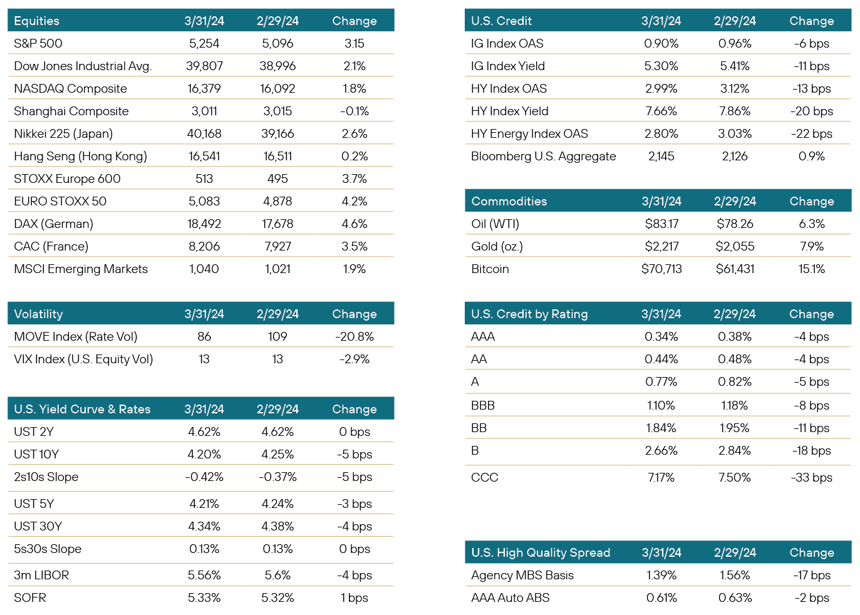

March was another good month for risk as equities rallied, credit spreads tightened, and volatility subsided. Bonds performed well across the credit stack with big performances from high-yield, on up to agency, and just about everything in between. The fixed income strength was aided by a benign month for Treasuries, as they jumped around but ultimately settled lower in yield, helping bond valuations. Investors enjoyed the month as the widespread rally included everything from ABS to commodities to international markets.

The route was nonetheless circuitous with Fed speak and data moving markets as usual. We began the month with Powell on Capitol Hill, saying he believes it will likely be appropriate to start cutting sometime this year but not until policymakers are sure the inflation fight has ended. Because the labor market is strong, they’ll have to wait on more inflation evidence prior to cutting, which is something we’ve heard of late from the majority of Fed officials.

Two days later, we had nonfarm payrolls surprise to the upside, but it brought downward revisions for the prior two months and a 2-year high in the jobless number. It was a mixed report that didn’t elicit a terribly strong reaction, as average hourly earnings and revisions assisted the narrative on wages. So, while February showed some acceleration in the jobs market, it was not in line with what we saw in January. In consequence, the market retained its pricing for 3+ rate hikes this year.

Next up was CPI, which brought a second straight hot reading: 0.4% core (vs. 0.3% expected) and 0.4% headline (vs. 0.4% expected). Year over year, core was 3.8% (vs. 3.7% expected), and headline was 3.2% (vs. 3.1% expected). Shelter, used cars, gas, and apparel were among the culprits, and the report suggested that January may not have been an anomaly. At the same time, however, a deceleration in services inflation should be considered positive for the Fed. Two days later, the retail sales figure was lower while Producer Price Index (PPI) was up (+0.8% vs. 0.6% estimated), with the latter suggesting some persistent inflation despite PPI not being a top-tier data point.

On the 19th, the Bank of Japan (BOJ) ended its era of negative rates, hiking just above zero. This was the world’s final remaining negative rate policy and forever part of monetary stimulus lore. The next day was the Fed meeting as officials held to their outlook of three cuts for 2024. They did, however, forecast fewer cuts for 2025 following the inflation uptick. The longer-run dot rose, along with core Personal Consumption Expenditures Price Index (PCE) forecasts for this year (but no change for 2025), while three-year growth forecasts were bumped higher. There was essentially no change to the Fed statement. The most notable thing that happened at the meeting was Powell saying that the Fed is fully committed to its 2% inflation target, as some market participants had recently speculated whether a higher floor could soon replace 2% as the permanent goal. Lastly, for March, on perhaps a slightly humorous note, on the 27th, Fed Governor Waller delivered a speech quite literally titled “There’s Still No Rush.”

Portfolio Review

And we’re back talking about rates again. Or at least the sell-off in rates. Rate volatility has found a new audience and seems to be keeping the market hostage. The front end of the curve remains the most disruptive, with overnight commercial paper offering rates still well over 5%. The inversion of the curve has now gone on for too many months to count despite the Fed sounding more and more at peace with their pace. While outwardly patient, the Fed seems interested, though not anxious, in still cutting rates in this calendar year. The market is starting to ignore that underlying feeling and instead seems to prefer pursuing the higher-for-longer mantra that was last loudest in mid-to-late 2023. The 2-year period, during which a good deal of attention is spent, managed to start and end the month in the same spot at 4.62%, despite spiking to as high as 4.73% mid-month. We continue to anticipate the possibility of some sort of rate cuts during the year and, as such, position the portfolio in a manner to best take advantage of a future desire for duration and where we expect the greatest bang for the buck once rate cuts do commence.

Noted asset sector targets or biases this month include:

- Commercial real estate is back in the news again. There have been several new headlines this past few weeks with regard to buildings and loans falling into bankruptcy and big-name investors simply walking away from obligations. Mostly the usual suspects in terms of space - old malls with Tier 2 and Tier 3 tenants, and office space. Of more importance, each of these anecdotes provides further evidence that the selling of the properties, far below initial purchased and booked prices and even adjusted valuations, is further evidence that there is a great deal of pain still to be dealt with in the space. The latest actions impacted CMBS deals, causing some investors up to $155 million in losses. Interestingly enough, CMBS has, amongst ABS in general, seen spreads tighten in agency and non-agency paper. We would anticipate that spreads at this point are way past levels that are appropriate given the risk of future events and that there is still severe widening in CMBS in general as more of these liquidations occur. We continue to have commercial real estate and CMBS as sectors to avoid.

- Corporate credit remains a neutral sector for us. We currently prefer investment grade credits over high yield as we continue to lean toward a better overall liquidity profile. Nevertheless, current credit spreads have been tight to those levels over the past few years, and in terms of historical levels, there is a question of value. Thus, the sector has been moved to represent more of a liquidity bucket and a place to park short-term investments to later sell at slight gains and to use that cash for other securities that we feel represent significantly more upside. This is certainly more true in short-duration instruments, while we still feel there is some upside in longer-duration, high-quality buckets such as utility and rail.

- Bank preferreds continue to be an attractive sector in our view. Larger global banks represent long-term value at current offering levels, given the regulatory pressure later inherent in their structure. What we anticipate to be lower rates years down the road, we would expect they will be called within their expected target dates. Furthermore, the larger global banks appear well-capitalized, and their balance sheets are positioned appropriately for future credit stress. Within the space, we do continue to avoid community banks and certain regional bank risks, as we remain concerned about commercial real estate exposures (see above).

- Agency debt is a sector representing solid short-term value in our view. Paper with longer calls is more attractive than shorter-term optionality and fits within our expectations of what the rate environment will look like. The paper remains a solid play for short-duration needs, for those funds with shorter horizons, as well as a comfortable place to build the front end of the maturity ladder for longer-duration funds.

- Agency MBS had a nice month in March after a slower start to the year. Current coupon dollar prices were up about a half point as the basis tightened around 16 bps. Performance in 30Y was distributed more evenly than usual across the coupon stack. At present, we expect some volatility, which may contribute to spread widening in the near term. Higher supply in the spring, along with largely absent bank demand and some money manager selling, represent possible headwinds. Longer term, our outlook is different. Mortgage bond spreads are still relatively wide as technical MBS demand did not return following banking issues a year ago. Notably, the current level of interest rates offers long-term performance potential for rate-driven products, leaving MBS return profiles attractive to us. We believe the asset class looks relatively cheap to corporate debt. Higher coupon securities at reasonable valuations offer sufficient carry to weather some of the aforementioned near-term market volatility in MBS if needed. Furthermore, as an unlevered buyer, we also see some good longer-term total return profiles in a few discounted areas of the 30Y, 20Y, and 15Y coupon stacks.

Positioning & Outlook

Issuance remains robust, and as a result, primary and secondary liquidity is readily available. Corporate issuance, even high yield, continued to be available, with announcements of anywhere from four to eight deals each day. Additionally, we continue to see ample demand for ABS new issuance, including one of the first aircraft ABS deals we have seen in quite a while. The reopening of that market and the continued new issuance of even more esoteric sectors such as data center ABS, triple net lease ABS, and even second lien non-agency Residential Mortgaged Backed Securities (RMBS) serve as a good reminder that demand remains strong enough. And if nothing else, perhaps too strong. The re-emergence of esoteric ABS deals has historically been a warning sign that demand is overheating. We remain wary of those types of deals and the approach of market participants as they once again seem to be chasing some wider-spread instruments. The robust liquidity is an opportunity to prune fully valued holdings once again and move into more preferred exposures, which offer, in our view, more future overperformance.

The market’s overall health is one of strength, with strong issuance meeting heavy demand. The only times for a pause are on certain days when there is anticipated economic data to be released, and the market halts for that release. Banks, which over the past few months have had some noteworthy headlines, mostly those community and regional banks, seemed to have found their stride, and even that type of noise has been limited. Rates have resumed being the focal point, with participants seemingly trying to decode what the numbers mean each and every time with regards to how the Fed views it and whether it means any type of shift from their rate cut path. Lately, the Fed speakers have seemingly been more inviting regarding rate cuts, although they keep stressing that there is no rush in their minds. A soft landing does seem more and more in the cards, and while the higher rates have certainly created tighter conditions, they seem not to be stifling. As such, the market, at least up to this point, seems to be in a good spot. We continue to feel some downward momentum in jobs numbers is forthcoming, and as such remain on the same path as the past several months. Our focus remains on higher credit quality, liquidity, and diversity.

The economy continues to chug along; however, we anticipate, at some point, a step back in employment and, thus, an ever-so-slight slowing. As such, we continue to be focused on maintaining a conservative approach to credit and a focus on liquidity and diversification going forward. This is done with a defensive mindset and by creating dry powder to take advantage of opportunities in the future to capture or lay the groundwork for potential overperformance. We feel the most opportunistic area for investment targets is still in the front end of the curve, in the 1-3 year area. However, we do look to lock in duration when available in higher credit and liquid exposures when opportunities exist in targeted issuers. Duration remains similar to the last few months, and we expect it to stay in that area for the near term.

Learn more about the Yorktown Short Term Bond Fund:

Definition of Terms

Basis Points (bps) - refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Curvature - A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Mortgage-Backed Security (MBS) - A mortgage-backed security is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

Collateralized Loan Obligation (CLO) - A collateralized loan obligation is a single security backed by a pool of debt.

Commercial Real Estate Loan (CRE) - A mortgage secured by a lien on commercial property as opposed to residential property.

CRE CLO - The underlying assets of a CRE CLO are short-term floating rate loans collateralized by transitional properties.

Asset-Backed Security (ABS) - An asset-backed security is an investment security—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables.

Option-Adjusted Spread (OAS) - The measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Enhanced Equipment Trust Certificate (EETC) - One form of equipment trust certificate that is issued and managed through special purpose vehicles known as pass-through trusts. These special purpose vehicles (SPEs) allow borrowers to aggregate multiple equipment purchases into one debt security

Real Estate Investment Trust (REIT) - A company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors.

London InterBank Offered Rate (LIBOR) - a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Secured Overnight Financing Rate (SOFR) - a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR).

Delta - the ratio that compares the change in the price of an asset, usually marketable securities, to the corresponding change in the price of its derivative.

Commercial Mortgage-Backed Security (CMBS) - fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Floating-Rate Note (FRN) - a bond with a variable interest rate that allows investors to benefit from rising interest rates.

Consumer Price Index (CPI) - a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Gross Domestic Product (GDP) - one of the most widely used measures of an economy's output or production. It is defined as the total value of goods and services produced within a country's borders in a specific time period—monthly, quarterly, or annually.

Perp - A perpetual bond, also known as a "consol bond" or "perp," is a fixed income security with no maturity date.

Nonfarm payrolls (NFPs) - the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications. This is measured by the federal Bureau of Labor Statistics (BLS), which surveys private and government entities throughout the U.S. about their payrolls.

Net Asset Value (NAV) - represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.

S&P 500 - The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

German DAX - The DAX—also known as the Deutscher Aktien Index or the GER40—is a stock index that represents 40 of the largest and most liquid German companies that trade on the Frankfurt Exchange. The prices used to calculate the DAX Index come through Xetra, an electronic trading system.

NASDAQ - The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.

MSCI EM Index - The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei - The Nikkei is short for Japan's Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Shanghai Composite - is a stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange.

Bloomberg U.S. Agg - The Bloomberg Aggregate Bond Index or "the Agg" is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

MOVE Index - The ICE BofA MOVE Index (MOVE) measures Treasury rate volatility through options pricing.

VIX Index - The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

Dow Jones Industrial Average - The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Hang Seng - The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

STOXX Europe 600 - The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Euro STOXX 50 - The EURO STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within eurozone nations.

CAC (France) - is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse).

U.S. MBS Index - The S&P U.S. Mortgage-Backed Securities Index is a rules-based, market-value-weighted index covering U.S. dollar-denominated, fixed-rate and adjustable-rate/hybrid mortgage pass-through securities issued by Ginnie Mae (GNMA), Fannie Mae (FNMA) and Freddie Mac (FHLMC).

Duration Risk - the name economists give to the risk associated with the sensitivity of a bond's price to a one percent change in interest rates.

Federal Open Market Committee (FOMC) - the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMO).

United States Treasury (UST) - the national treasury of the federal government of the United States where it serves as an executive department. The Treasury manages all of the money coming into the government and paid out by it.

High Yield (HY) - high-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Investment Grade (IG) - an investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Exchange Traded Fund (ETF) - an exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock.

Federal Family Education Loan Program (FFELP) - a program that worked with private lenders to provide education loans guaranteed by the federal government.

Business Development Program (BDC) - an organization that invests in small- and medium-sized companies as well as distressed companies.

Job Opening and Labor Turnover Survey (JOLTS) Report - is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

Sifma - The Securities Industry and Financial Markets Association (SIFMA) is a not-for-profit trade association that represents securities brokerage firms, investment banking institutions, and other investment firms.

Duration - A calculation of the average life of a bond (or portfolio of bonds) that is a useful measure of the bond's price sensitivity to interest rate changes. The higher the duration number, the greater the risk and reward potential of the bond.

Trust Preferred Securities (TruPS) - hybrid securities issued by large banks and bank holding companies (BHCs) included in regulatory tier 1 capital and whose dividend payments were tax deductible for the issuer.

Treasury Inflation-Protected Securities (TIPS) - are a type of Treasury security issued by the U.S. government. TIPS are indexed to inflation to protect investors from a decline in the purchasing power of their money. As inflation rises, rather than their yield increasing, TIPS instead adjust in price (principal amount) to maintain their real value. The interest rate on a TIPS investment is fixed at the time of issuance, but the interest payments keep up with inflation because they vary with the adjusted principal amount.

Disclosures

You should carefully consider the investment objectives, potential risks, management fees, charges and expenses of the fund before investing. The fund's prospectus contains this and other information about the fund and should be read carefully before investing. You may obtain a current copy of the fund's prospectus by calling 800-544-6060.

Per the most current prospectus, (1) Fund total operating expense ratios are: Class A, 0.92%; Class L, 1.57%; Institutional Class, 0.92% until at least May 31, 2024. (2) In addition, the Adviser has entered into a a contractual expense limitation agreement with the Trust so that the Fund’s ratio of total annual operating expenses are limited to 0.84% for Class A shares and Institutional Class shares and 1.49% for Class L Shares until at least May 31, 2024.

Fixed income investments are affected by a number of risks, including fluctuation in interest rates, credit risk, and prepayment risk. In general, as prevailing interest rates rise, fixed income securities prices will fall.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. There is no guarantee that this, or any, investing strategy will succeed.

Diversification does not ensure a profit or guarantee against loss.

There is no affiliation between Ultimus Fund Distributors, LLC and the other firms referenced in this material.