Macro Update

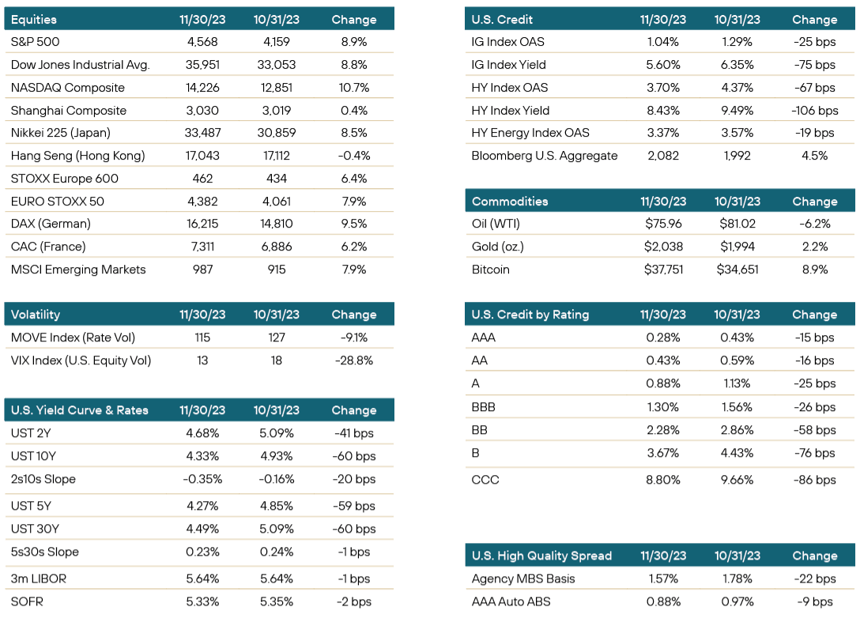

Risk assets surged in November. The market delivered a major rebound from the preceding two months in the form of one of the strongest all-around months ever recorded. The rally stretched across asset classes as equities, interest rates, and credit spreads all performed extremely well. The U.S. Treasury curve bull flattened with the 2Y and 10Y better by 41 bps and 60 bps, and in corporate credit, IG and HY tightened by 25 bps and 67 bps. Agency MBS spreads and ABS spreads had a strong month as well.

November represented a change in direction for the markets and this began right at the outset, as most of the action took place in the first half of the month before the holidays kicked off. On November 1st, ADP payrolls arrived below expectations. On the 2nd, the Fed meeting concluded and investors took the statement and press conference as further evidence that the hiking cycle is likely done. With the funds rate unchanged at 5.25%-5.5%, the Fed indicated that the organic tightening from the recent rise in yields had reduced the need to hike (although they did not close the door on it). The slightly dovish messaging spurred a large rate rally across the curve. Jerome Powell downplayed the economic growth rate and the recent jump in one-year inflation expectations, reiterating that tighter financial and credit conditions are likely to weigh on economic activity. Additionally, on November 3rd, the October nonfarm payrolls release surprised to the downside at 150k vs. a 180k forecast. Unemployment rose slightly and there were downward revisions to September and August. Average hourly earnings also decelerated, and, all in all, these produced a weak report that capped an enormous three-day Treasury rally to start the month.

An interlude of volatility followed the euphoria with traders taking gains in fixed income, pushing down bond prices temporarily. And, during this stretch, Powell generated an additional leg of the selloff with some cautionary language in an address to the IMF. He warned investors against complacency by stating that he’s not confident the Fed has achieved the stance needed to restore 2% inflation, further adding that they won’t hesitate to tighten more, if appropriate. Nonetheless, the good feelings were restored a few days later with a lower-than-expected reading on core CPI on November 14th, which showed CPI as unchanged in October. Shelter and used auto numbers were encouraging, reinforcing the disinflation trend, and “supercore” (services ex rents and energy) rose just slightly. With the reassuring inflation data, bonds stayed mostly well bid for the remainder of the month, into and past the Thanksgiving holiday. Lastly and notably, Christopher Waller, the usually-hawkish Fed Governor, remarked near month-end that he himself believes the Fed is done for now.

Portfolio Review

The fixed-income market gave thanks in November. In mid-October, there seemed no relief regarding rates on the horizon. It had been a steady march up in yields, hitting a high for the 2-year treasury at 5.22% on October 18. And then, just like that, rates began to rally. And by the end of this dramatic march and the end of the month of November, the yield on the 2-year treasury was 4.68%. A genuine move of over 50 bps, and the momentum of the movement suggests we could see yields continue to move in that direction. Whereas over the last few months, we could see that the end may be near, it would seem there were still doubts in the market once it came. Indeed, it didn’t stop Chairman Powell from dampening the enthusiasm as he stepped forward to reiterate his view that there might still be tightening in the future. However, we continue to see enough slowing indications in the economy that the bond market is choosing to ignore him for the moment. We continue to monitor economic data for any indications that this rate move might be a false flag. Nevertheless, we have anticipated that the slowing would occur, and positioning in the portfolio reflects that and an expectation of further slowing and a further beneficial movement in treasury yields.

Noted asset sector target or bias this month includes:

- We continue to focus on Agency MBS as a targeted sector. November brought good news for Agency MBS as current coupon 30Y pools appreciated by more than three points, bolstered by the rate move and spread tightening. This was a welcome relief from the bear-steepening action experienced by yields since midsummer. Meanwhile, MBS spreads, though wide, are unlikely to tighten much more in the near term, but the current level of interest rates offers long-term performance potential for rate-driven products. Thus, our view remains that the longer-term investment profile for MBS is attractive and that the asset class looks cheap to corporate debt and Treasuries. Higher coupon securities at inexpensive valuations offer sufficient carry to weather the current market volatility in MBS, and, as an unlevered buyer, we also see good total return profiles in various discounted areas of the coupon stack.

- Real estate is once again capturing headlines, especially with the still-unwinding story of Evergrande in China. With plenty of concern still focused domestically on office space and the lag of those issues, including those found in CRE and loan-level ripples, the foreign real estate issues are obviously unwelcome news to those who play heavily in this space. We continue to avoid real estate overall, especially commercial real estate. There is a sudden market push by dealers for newer vintage CMBS deals, but issuance thus far has been light, and there is contagion risk from headlines still to deal with even if the newer vintages are lighter on office space risk and structured better. Headlines are impactful regarding valuations, and the sector seems uninviting with still more fallout coming from China.

- As mentioned above, ABS issuance has been robust in the last few months of this calendar year. Despite this, there has been enough demand to tighten spreads in certain classes on certain deals. That is a step in the right direction for the sector. It also has created upside in secondary trading opportunities. We continue to like auto ABS, but similar to our mantra the last year, we prefer secondary pieces and older vintages with healthy performance data to pour over. We are concerned that newer vintages don’t have enough time for us to see just how the consumer is going to react in this higher-rate environment and how that will affect payment history. We also prefer ABS, in general, moving up in the credit stack, preferring the more senior tranches going forward as we muddle through whatever issues the consumer may or may not have. Esoteric ABS is an avoid, as we don’t feel there is any reason to venture into this sector of the securitization world that has far less liquidity than other more proven sectors such as auto, credit card, and equipment leasing.

- With a drop in yields, preferreds once again are in demand. The bigger banks are of far more interest, with more recent issues carrying large, desired coupons and seeing significant appreciation. This targeted security includes some of the newer, larger Yankee banks as well. We like them even with the uptick in price, as we feel there is still value to be captured. Less of interest are the corporate, insurance, or utility names, as most of those are stale vintages with limited liquidity. We consider preferreds more of a neutral sector currently. We are happy to add selective names if the opportunity presents itself, but we are also content with current exposures in the sector.

- Agency paper is an attractive sector. The pick-up in terms of yield and performance, especially if we see a slowing economy and some pullback in credit, remains a near-term possibility. We like callable paper as we expect a shorter maturity and, as a result, near-term overperformance.

Positioning & Outlook

With rate pressures easing some, credit seems to be attractive again to market participants. We continue to be concerned about what fallout the higher rates ultimately weighed on weaker corporate credits and the consumer. Additionally, with a slowing economy leading the charge as a focal point in the rate rally, it seems counterintuitive that reaching for credit would be a worthy play. Indeed, the higher coupon high-yield securities become more attractive in a lower rate environment, but we continue to prefer to move up in credit as a response. We would expect a lag in terms of discovering just how damaging the higher rates were overall. As such, with an expectation that future data will be indicative of slowing economic activity and a drop-off in terms of consumer credit, we have moved further into more liquid, higher credit quality exposures. We continue to prefer said higher credit quality and feel that even at these still-elevated yield levels, investors are being compensated appropriately for better, more attractive risk. Our approach remains to be patient with credit and to prefer to be up in credit, favoring specific, more defensive sectors.

Liquidity overall is robust. Primary liquidity is extremely healthy, with issuers rushing to the market to get year-end funding down and what now appears far more attractive financing costs than just a month ago. There certainly seems to be strong demand for corporate issuers both in high grade and high yield, and the ABS market, especially for November, seemed active. Several deals in auto ABS and consumer credit were launched, and spreads continued to march in due to the demand. Subscriptions were not overwhelming just yet, but strong enough to cause specific deals and certain classes to see enough demand to give dealers confidence they could accomplish funding needs at slightly tighter levels. Secondary liquidity has been strong as well. Even at this late stage of the calendar, dealers seem open to making bids and taking risks. There is enough customer-to-customer demand to create strong bid-ask spreads with smaller dealer desks representing solid secondary liquidity. As we approach the end of the year, activity will slow, but current levels of liquidity are solid and conducive to a strong market.

Overall, the market is in a better spot than it has been for a while. As a result, we continue to use the good feelings and strong bid for credit to move forward on our investment thesis. Our focus has been on credit, liquidity, and diversity, and we remain committed to that near-term viewpoint. As credit turns, there will be future opportunities to take advantage of, but we are content to take the stronger credits at these still-attractive levels.

We reiterate our investment thesis of the previous months: taking a conservative approach to credit and remaining positioned for a slower economy. Avoiding surprises and managing the few bumps that might still be in our path is the goal. We do expect high-yield credit to soften and want to avoid any ripples from that occurring as we close the year out. We continue to see more probability of a downturn and, as such, remain focused on liquidity, credit, and diversification. The front end of the curve remains the most opportunistic area for investment targets, and we still feel we find the most value in the 1-3-year area. Duration has moved out a little bit, but it is still near the most recent levels, and we expect it to stay in that area for the near term.

Learn more about the Yorktown Short Term Bond Fund:

Definition of Terms

Basis Points (bps) - refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Curvature - A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Mortgage-Backed Security (MBS) - A mortgage-backed security is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

Collateralized Loan Obligation (CLO) - A collateralized loan obligation is a single security backed by a pool of debt.

Commercial Real Estate Loan (CRE) - A mortgage secured by a lien on commercial property as opposed to residential property.

CRE CLO - The underlying assets of a CRE CLO are short-term floating rate loans collateralized by transitional properties.

Asset-Backed Security (ABS) - An asset-backed security is an investment security—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables.

Option-Adjusted Spread (OAS) - The measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Enhanced Equipment Trust Certificate (EETC) - One form of equipment trust certificate that is issued and managed through special purpose vehicles known as pass-through trusts. These special purpose vehicles (SPEs) allow borrowers to aggregate multiple equipment purchases into one debt security

Real Estate Investment Trust (REIT) - A company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors.

London InterBank Offered Rate (LIBOR) - a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Secured Overnight Financing Rate (SOFR) - a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR).

Delta - the ratio that compares the change in the price of an asset, usually marketable securities, to the corresponding change in the price of its derivative.

Commercial Mortgage-Backed Security (CMBS) - fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Floating-Rate Note (FRN) - a bond with a variable interest rate that allows investors to benefit from rising interest rates.

Consumer Price Index (CPI) - a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Gross Domestic Product (GDP) - one of the most widely used measures of an economy's output or production. It is defined as the total value of goods and services produced within a country's borders in a specific time period—monthly, quarterly, or annually.

Perp - A perpetual bond, also known as a "consol bond" or "perp," is a fixed income security with no maturity date.

Nonfarm payrolls (NFPs) - the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications. This is measured by the federal Bureau of Labor Statistics (BLS), which surveys private and government entities throughout the U.S. about their payrolls.

Net Asset Value (NAV) - represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.

S&P 500 - The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

German DAX - The DAX—also known as the Deutscher Aktien Index or the GER40—is a stock index that represents 40 of the largest and most liquid German companies that trade on the Frankfurt Exchange. The prices used to calculate the DAX Index come through Xetra, an electronic trading system.

NASDAQ - The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.

MSCI EM Index - The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei - The Nikkei is short for Japan's Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Shanghai Composite - is a stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange.

Bloomberg U.S. Agg - The Bloomberg Aggregate Bond Index or "the Agg" is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

MOVE Index - The ICE BofA MOVE Index (MOVE) measures Treasury rate volatility through options pricing.

VIX Index - The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

Dow Jones Industrial Average - The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Hang Seng - The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

STOXX Europe 600 - The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Euro STOXX 50 - The EURO STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within eurozone nations.

CAC (France) - is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse).

U.S. MBS Index - The S&P U.S. Mortgage-Backed Securities Index is a rules-based, market-value-weighted index covering U.S. dollar-denominated, fixed-rate and adjustable-rate/hybrid mortgage pass-through securities issued by Ginnie Mae (GNMA), Fannie Mae (FNMA) and Freddie Mac (FHLMC).

Duration Risk - the name economists give to the risk associated with the sensitivity of a bond's price to a one percent change in interest rates.

Federal Open Market Committee (FOMC) - the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMO).

United States Treasury (UST) - the national treasury of the federal government of the United States where it serves as an executive department. The Treasury manages all of the money coming into the government and paid out by it.

High Yield (HY) - high-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Investment Grade (IG) - an investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Exchange Traded Fund (ETF) - an exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock.

Federal Family Education Loan Program (FFELP) - a program that worked with private lenders to provide education loans guaranteed by the federal government.

Business Development Program (BDC) - an organization that invests in small- and medium-sized companies as well as distressed companies.

Job Opening and Labor Turnover Survey (JOLTS) Report - is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

Sifma - The Securities Industry and Financial Markets Association (SIFMA) is a not-for-profit trade association that represents securities brokerage firms, investment banking institutions, and other investment firms.

Duration - A calculation of the average life of a bond (or portfolio of bonds) that is a useful measure of the bond's price sensitivity to interest rate changes. The higher the duration number, the greater the risk and reward potential of the bond.

Trust Preferred Securities (TruPS) - hybrid securities issued by large banks and bank holding companies (BHCs) included in regulatory tier 1 capital and whose dividend payments were tax deductible for the issuer.

Treasury Inflation-Protected Securities (TIPS) - are a type of Treasury security issued by the U.S. government. TIPS are indexed to inflation to protect investors from a decline in the purchasing power of their money. As inflation rises, rather than their yield increasing, TIPS instead adjust in price (principal amount) to maintain their real value. The interest rate on a TIPS investment is fixed at the time of issuance, but the interest payments keep up with inflation because they vary with the adjusted principal amount.

Disclosures

You should carefully consider the investment objectives, potential risks, management fees, charges and expenses of the fund before investing. The fund's prospectus contains this and other information about the fund and should be read carefully before investing. You may obtain a current copy of the fund's prospectus by calling 800-544-6060.

Per the most current prospectus, (1) Fund total operating expense ratios are: Class A, 0.92%; Class L, 1.57%; Institutional Class, 0.92% until at least May 31, 2024. (2) In addition, the Adviser has entered into a a contractual expense limitation agreement with the Trust so that the Fund’s ratio of total annual operating expenses are limited to 0.84% for Class A shares and Institutional Class shares and 1.49% for Class L Shares until at least May 31, 2024.

Fixed income investments are affected by a number of risks, including fluctuation in interest rates, credit risk, and prepayment risk. In general, as prevailing interest rates rise, fixed income securities prices will fall.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. There is no guarantee that this, or any, investing strategy will succeed.

Diversification does not ensure a profit or guarantee against loss.

There is no affiliation between Ultimus Fund Distributors, LLC and the other firms referenced in this material.

Control #: 17698244-UFD 12/15/2023