Macro Update

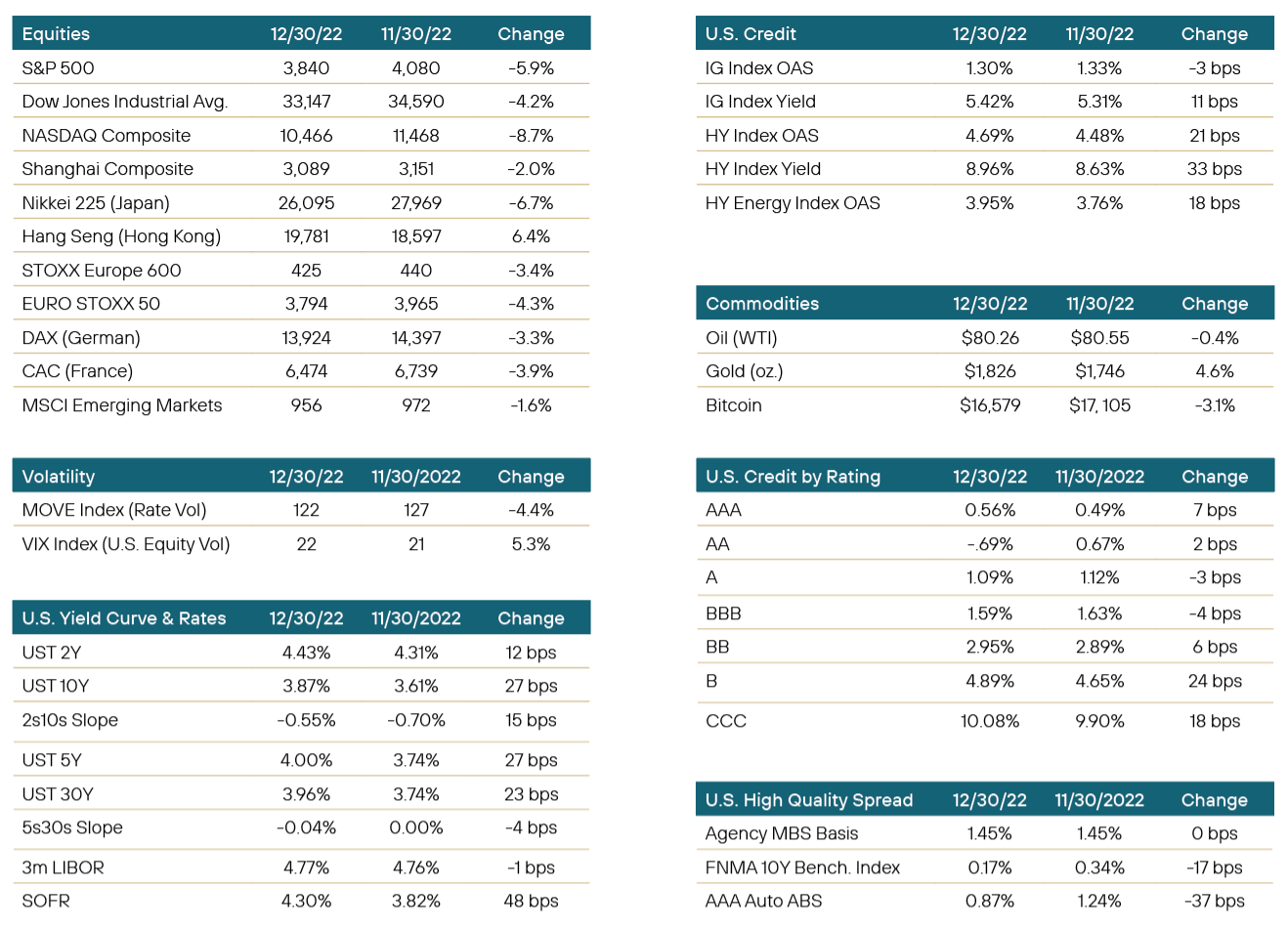

Lower equity prices and higher bond yields in December capped one of the most difficult years in memory for financial markets. The U.S. and Japan felt the worst of the December moves, with the S&P falling 5.9% and the Nikkei losing 6.7%. Yield curves remained inverted while also bear-steepening. The U.S. 2s-10s was 15 bps higher to finish the year at -55 bps. In 2022, the 2Y UST sold off by a staggering 369 bps. On the other hand, investment grade corporate credit spreads hung in reasonably well for the month. While AAA (+7 bps) and AA (+2 bps) widened, single A (-3 bps) and BBB (-4 bps) spreads tightened. Agency MBS spreads were unchanged overall while agency benchmark debt tightened nicely (-17 bps for the 10Y agency benchmark index). AAA auto ABS performed exceptionally well and ended 37 bps better. High yield finished wider, meanwhile, as the U.S. corporate OAS composite was off 21 bps to finish at 4.69%. Both rate and equity volatility held mostly in check for the month.

Data-wise there was some good and some bad. Yields surged higher following an early month jobs report that missed on every level (average hourly earnings in particular). The report was not what the Fed and market had wanted to see, but two weeks later an encouraging CPI report shifted the sentiment. The headline figure came in at 7.1% compared to the 7.3% that had been expected, and we got the smallest monthly advance in inflation in more than a year. The good news provided hope that maybe the worst of inflation has passed. In consequence, the market rallied substantially on this deceleration, offering hope that the result might be a less aggressive Fed. Within the CPI report, lower core goods and energy prices aided in offsetting increasing shelter and food costs.

A day later the December Fed meeting wrapped up. Per expectation, the Fed downshifted to a 50 bps increase in the funds rate. The updated dot plot gave investors reason for concern as 17 of 19 members projected a terminal rate north of 5% - a disclosure at odds with the rate futures market’s predictions. The FOMC showed a year-end 2023 target range of 5%-5.25% but the market believes this terminal rate forecast to be too high. Jerome Powell emphasized that rate hikes are ongoing and that policy is not yet sufficiently restrictive. He urged investors to not expect a quick reversal in the fight against inflation. He stated that despite the expectation for a large drop in inflation in 2023, the Fed’s efforts have a long way to go and that recession is fairly likely. The table is undoubtedly set for ongoing tension between rates markets and the Fed forecast.

Global attention turned to Asia in the latter half of December. In a significant surprise, the Bank of Japan raised its target range for yields. This was a very noteworthy tightening, given Japan’s situation and its status as the last major central bank to resist a move away from easy monetary policy (which it has maintained for decades). The news led to a global bond repricing with risk assets getting hit hard. China was the next to roil markets with its post-COVID reopening news in the final week of the year. In another case of “good news is bad news,” bond yields rose due to the danger of increased growth projections from reopening leading to higher inflation.

Portfolio Review

And just like that, the holidays are over. The last few weeks of the market were defined by a lack of new issue, market interaction, or even participation. Most accounts, and dealers, spent the last few weeks of the year simply doing asset swaps, if they even did that. Perhaps capitulation is a better way of looking at it, and most were simply counting down the days for the year to be over. The Fed did provide the expected, almost anti-climactic, 50 bps hike in mid-month, and we got the required Fed speak into the end of the month, but not much drama there. Instead, many watched as a shallow market with dealer desks and investor desks seemingly manned by junior personnel simply move wider in rates with no real push back. And most seemingly shrugged and waited for the calendar to turn. The year ended with the terminal rate expectations slightly under 5.0%. So no real change from the end of the last month.

Noted asset sector target or bias this month includes:

- We remain mostly constructive on Agency MBS. While the product tightened substantially in November, December was muted and spreads remained near their longer-term wides. Questions relating to demand technicals prevail, such as whether or not domestic banks and foreign central banks will be buyers soon. Moreover, future rate volatility is highly uncertain, and if yields continue to rise, further extension risk is a threat to MBS prices. The question of a Fed pivot looms large. In the meantime, we find higher carry, newer product to be attractive, as well as certain segments of the discount MBS universe that offer total return opportunities.

- Corporate credit remains attractive overall, with a strong preference for investment grade credit over high yield. With limited issuance in the primary market for IG credits, and high yield standing down, due to volatility and investors’ decision to sit the last month out (see above), secondary offerings tended to be attractive. However, targeted names were in the defensive sectors we have preferred over the past few months, and in more liquid names and issuance sizes. More value was found in commercial paper (CP), with Tier 2 and Tier 3 paper more attractive, due to a smaller investor base demand and more attractive yield profiles. High yield was less desirable, with additional negative headlines toward year-end promulgating regarding leveraged loans and secured bank loans. The loan market, which can be more correlated to high yield, was subject to many articles detailing issues not only with the sector directly but secondary concerns around low rated CLO tranches and their potential poor performance hurting those sub-tranches in the CLO credit stack. Loans are still a heavy concentration is some competitor portfolios, and we continue to avoid direct exposure to that sector, given credit performance expectations going forward and potential issues with regards to warehouses in new CLO deal ramping-up and deal performance in certain sub-classes in legacy deals.

- Yankee banks continue to have negative headlines and so opportunities in certain names with contagion credit risk spread widening are available. Especially so it would seem in Canadian bank names, which have had a few hiccups of late. More importantly is domestic bank paper, which continues to seem attractive. Heavy issuance in this market can sometimes cause some to ignore it, additionally, many investors find their buckets in these names full, given their preponderance of issuance. However, as we approach year-end, bank paper seems attractive on a total return basis, especially in solid liquid names. Nevertheless, it is important to stick to newer, larger issuance as stale, smaller issuance quickly becomes less liquid sooner than later. With heavy issuance over the past year, there are many solid deals to look over and find value. Community bank paper continues to be on our avoid list. Investor base, which is typically heavily insurance company or regional bank populated has slowed investor needs into the last month and thus the paper has seen demand wane. Furthermore, as we approach a potential slow down economically, it is important to note those banks typically are heavily over-exposed to local commercial real estate-related deals. As such, an economic slow down could impact some of those banks if underwriting standards have relaxed over the past few years. With potential credit concerns on our radar and widening credit spreads due to lack of secondary activity, we will not be adding to that exposure in the near term.

- Treasuries continue to be a favored sector. Yields remain attractive, given the rate hikes. Furthermore, some notable pick-up is available in low coupon secondary paper, where there is some slight overperformance to be had as rate hikes continue. Overall, we remain more comfortable with certain parts of the curve, with the short end seemingly offering more upside from a performance standpoint. We remain constructive on the short end of the curve, 1-to-3-year notes which have rolled down the curve at heavy discounts, with additional interest in 20-year notes when looking further out the curve.

- Asset-backed securities (ABS) primary market activity ceased in the last month, similar to other asset classes. Additionally, with limited investor activity, secondary activity was fairly limited. Nevertheless, we continue to like the sector overall and find real value with recent spread widening available, especially as we ponder a return to normal market activity come the new year. With expected spread tightening almost a given, value across the liquid asset types such as auto ABS, and some of the more esoteric asset classes such as rail and container remain attractive. Of concern is newer issue auto ABS, with falling used car prices and slowing sales, new deals might see some uptick in delinquencies. As a result, our preference remains in finding more value in secondary, legacy deals with longer historical performance that we can track and which have already built up additional credit cushions for any negative credit performance that might impact deals in the future. Whole business securitization remains on our avoid list as a sub-sector. The limited liquidity of those esoteric types and limited dealer support, as well as a potential slowing economy might influence spreads in a negative fashion making the already limited liquidity sectors such as franchise and data center deals even more difficult to buy and sell as well as hurt performance causing further spread widening.

- Hybrids remain a neutral sector for us. We continue to like certain issuers, and while spreads have widened out, correlation to the equity market on pricing for these securities remains seemingly higher than normal. On a positive note, issuers are becoming more aggressive about exercising calls on the paper, as they contemplate the higher interest rate resets for those deals that have transitioned from fixed to floating rate. This type of response from issuers has investors revisiting the deeply discounted deals, anticipating at worst, attractive tenders for those deals that can’t be called yet.

Positioning & Outlook

There is a general feeling in the market that rates are so yesterday. That is, most participants seem to accept that the rate hike cycle has run its course and no real spikes are seen. Nevertheless, as we await future data points in the new year, we remain wary of getting too far ahead of the curve and remain a bit conservative in our stance on rates. As such, we prefer a more neutral viewpoint, preferring to assume we will continue to see certain days where rates sell off viciously and others where rates rally on the back of adequate data bolstered by the enthusiasm of those anxious to see the cycle end already.

Liquidity at end of year is tight. Most were trying to lock in performance over past few months, and so there is less eager participants in December as the calendar winds down. With rates, activity, and participation so low, we remained committed to hoarding cash for opportunity buys but also as a means to providing some buying power once the market returned in full force in January.

The market feels like it has developed some comfort with the direction of the Fed and expectations for any future Fed action or inaction. As a result we continue to expect rates to rally some but overall remain far less volatile than the previous year was witnessed. We do expect a change in the credit cycle as we look forward and some credit issues in the lower end of the corporate credit stack such as single B and CCC credits. We end the year and begin the next with a similar outlook, and remain constructive but conservative in our outlook, preferring to keep powder dry for opportunity trades and keeping risk shorter. We continue to prefer highly liquid and high credit quality at wider spreads names. Maturities remain on the shorter side, but we like the 2–3-year corporate tenor in terms of value. We would expect duration to remain near current levels over the near term.

Learn more about the Yorktown Short Term Bond Fund:

Definition of Terms

Basis Points (bps) - refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Curvature - A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Mortgage-Backed Security (MBS) - A mortgage-backed security is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

Collateralized Loan Obligation (CLO) - A collateralized loan obligation is a single security backed by a pool of debt.

Commercial Real Estate Loan (CRE) - A mortgage secured by a lien on commercial property as opposed to residential property.

CRE CLO - The underlying assets of a CRE CLO are short-term floating rate loans collateralized by transitional properties.

Asset-Backed Security (ABS) - An asset-backed security is an investment security—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables.

Option-Adjusted Spread (OAS) - The measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Enhanced Equipment Trust Certificate (EETC) - One form of equipment trust certificate that is issued and managed through special purpose vehicles known as pass-through trusts. These special purpose vehicles (SPEs) allow borrowers to aggregate multiple equipment purchases into one debt security

Real Estate Investment Trust (REIT) - A company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors.

London InterBank Offered Rate (LIBOR) - a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Secured Overnight Financing Rate (SOFR) - a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR).

Delta - the ratio that compares the change in the price of an asset, usually marketable securities, to the corresponding change in the price of its derivative.

Commercial Mortgage-Backed Security (CMBS) - fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Floating-Rate Note (FRN) - a bond with a variable interest rate that allows investors to benefit from rising interest rates.

Consumer Price Index (CPI) - a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Net Asset Value (NAV) - represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.

S&P 500 - The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

German DAX - The DAX—also known as the Deutscher Aktien Index or the GER40—is a stock index that represents 40 of the largest and most liquid German companies that trade on the Frankfurt Exchange. The prices used to calculate the DAX Index come through Xetra, an electronic trading system.

NASDAQ - The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.

MSCI EM Index - The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei - The Nikkei is short for Japan's Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Shanghai Composite - is a stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange.

MOVE Index - The ICE BofA MOVE Index (MOVE) measures Treasury rate volatility through options pricing.

VIX Index - The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

Dow Jones Industrial Average - The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Hang Seng - The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

STOXX Europe 600 - The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Euro STOXX 50 - The EURO STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within eurozone nations.

CAC (France) - is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse).

Duration Risk - the name economists give to the risk associated with the sensitivity of a bond's price to a one percent change in interest rates.

Federal Open Market Committee (FOMC) - the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMO).

United States Treasury (UST) - the national treasury of the federal government of the United States where it serves as an executive department. The Treasury manages all of the money coming into the government and paid out by it.

High Yield (HY) - high-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Investment Grade (IG) - an investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Exchange Traded Fund (ETF) - an exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock.

Federal Family Education Loan Program (FFELP) - a program that worked with private lenders to provide education loans guaranteed by the federal government.

Business Development Program (BDC) - an organization that invests in small- and medium-sized companies as well as distressed companies.

Disclosures

You should carefully consider the investment objectives, potential risks, management fees, charges and expenses of the fund before investing. The fund's prospectus contains this and other information about the fund and should be read carefully before investing. You may obtain a current copy of the fund's prospectus by calling 800-544-6060.

Per the most current prospectus, (1) Fund total operating expense ratios are: Class A, 0.87%; Class L, 1.52%; Institutional Class, 0.87% until at least May 31, 2023. (2) In addition, the Adviser has entered into contractual expense limitation agreement with the Trust so that the Fund’s ratio of total annual operating expenses are limited to 0.84% for Class A shares and Institutional Class shares and 1.49% for Class L Shares until at least May 31, 2023.

Fixed income investments are affected by a number of risks, including fluctuation in interest rates, credit risk, and prepayment risk. In general, as prevailing interest rates rise, fixed income securities prices will fall.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. There is no guarantee that this, or any, investing strategy will succeed.

Diversification does not ensure a profit or guarantee against loss.

There is no affiliation between Ultimus Fund Distributors, LLC and the other firms referenced in this material.

Control #: 16279455-UFD-1/13/2023