Macro Update

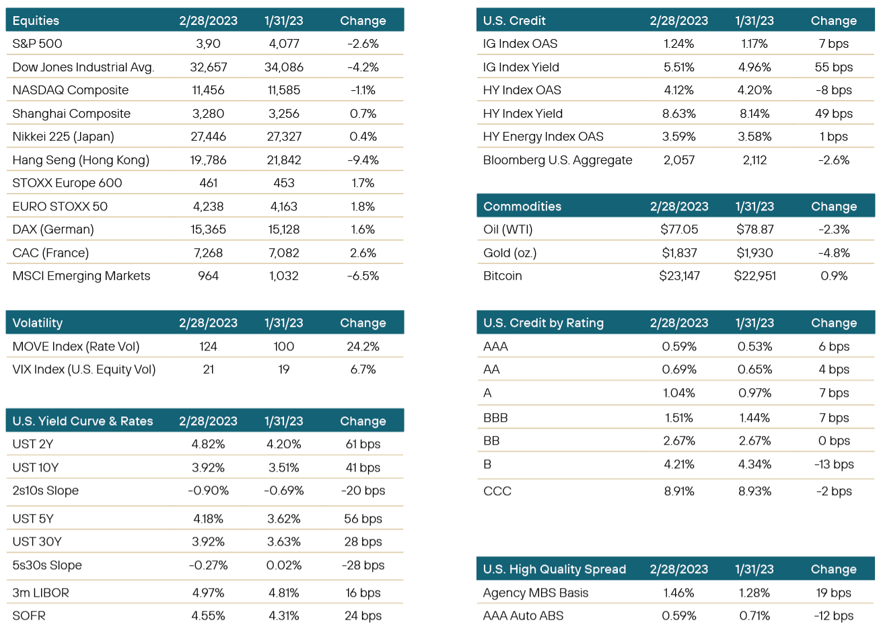

A harsh February brought bearish volatility back to the market following January’s euphoria. Most notably, extreme moves in the U.S. Treasury curve created a significant repricing in the bond market. The curve bear flattened by 19 bps, with the 2Y and 5Y Treasuries undergoing enormous shifts of around 60 bps in yield. Investors seemed to be finally acquiescing to the Fed’s beliefs that rates will need to be higher for longer, and an additional 75-100 bps are now priced into Fed Funds futures. Once again, February followed the familiar road map of key monthly data releases and Fed speak.

The Fed meeting on February 1st offered a statement that was initially interpreted as somewhat hawkish versus expectation. The central bank emphasized that the terminal Fed Funds rate was not a done deal yet while expressing the potential seriousness of not doing enough to combat inflation. In the press conference, Chair Powell emphasized services sector inflation and tightness in the labor market remain concerns, adding that “the labor market is out of balance.” He went on to say “the job is not fully done” on inflation given we haven’t seen meaningful signs of disinflation in core services ex housing, and that it would “be very premature to declare victory.” Markets were confused as Powell later acknowledged some progress on disinflation, and rates responded with a partial rally.

Just two days later the monthly non-farm payrolls report hit the tape and headline numbers were much stronger than expected. A net upward revision was also given to the two prior months, while the unemployment rate fell from 3.5% to 3.4% despite an increase in labor force participation. There was some relief, however, in the average hourly earnings annual figure, which slowed. Rates sold off on the strong report.

Next in line was CPI on February 14th which offered a mixed inflation picture. On a month over month basis, CPI was roughly as expected, while the year over year headline figure of 6.4% moderated less than hoped, arriving 0.2% higher than anticipated. It was not a bad report, perhaps, but it did not show the decline needed to potentially induce a Fed pivot in the near future. Looking at core components within the report, we saw decreases for used vehicles, air fare, and medical care costs, while household furnishings, clothing, shelter and insurance all rose. Rates sold off as a result of the market capitulating to the idea that controlling inflation will take longer than expected. Most observers agreed that the Fed will continue hiking its benchmark rate until services sector inflation shows meaningful decline. Lastly the Producer Price Index (PPI) came in very hot. Also of note, Loretta Mester (non-voting) of the Cleveland Fed stated that she would have preferred a 50 bps hike at the previous meeting.

Portfolio Review

February is a short month, but this year seemed much longer. The jobs numbers and other economic data dampened a market that had spent the previous month’s good cheer and enthusiasm. With that data exhibiting signs of an economy not quite yet ready to slow down, attention once again turned to the Fed and the FOMC members didn’t spare any time getting out and giving hawkish speeches. And just like that, we were once again left to wonder just how much more room rate hikes had left to run. The aggressiveness of the Fed had started to burn most participants out. There is still a great deal of discussion and thought on not quite knowing how much of a lag is involved in the hikes influencing the economic environment. Current expectations are that jobs data, for instance, can be generally a 2-3 month lag. Thus, as we have pointed out previously, while many companies have announced layoffs, it can take (based on things such as state requirements) some time before layoffs turn into actual job losses. Thus, there is a very real possibility that while layoffs have been announced, jobs data for a few months after won’t show the carnage just yet, giving off an illusion of a healthier employment market. Further, there have already been numerous indications from large retailers who have been warning that their expectations are that the consumer is indeed pulling back. And yet, retailing data shows a consumer eager to spend. In both these instances, it would be expected that, in addition to the impact of previous rate hikes, that the near term economic performance may begin to slow. Furthermore, if so, that would seem to suggest that while the Fed has indicated that once they reach their terminal rate, we can expect rates to stay there it is very possible that won’t be the case and rate cuts could start sooner than expected.

The primary market was healthy during the month, despite the rate pressures. Strong issuers came to market and saw solid demand for their issuances. This was the case in high grade and high yield. Secondary activity was also robust, with liquidity in the market strong across the board. This included strong demand in every type of security from asset-backed securities (ABS), CLO, corp risk and even down to hybrids, which rallied strongly during the month. The solid primary and secondary liquidity were a good sign that there is cash to be deployed and interested investors. A healthy sign, despite rates once again dampening the mood.

Noted asset sector target or bias this month includes:

- Private credit became all the rage over the recent past, with banks taking a step back during the low rate environment and private equity-like money eager to get a foothold in the middle market direct lending sector. Even with rates pushing back up, banks have been less enthusiastic about re-entering the market, given that some of them were left at 2022 year-end still holding on their balance sheets large amounts of loans from large, well known end of year deals that they were unable to sell. However, those loans that private credit eagerly originated are now considered a bit worrisome, given that those liabilities are floating rate, and have now reset and are going to keep resetting to higher and higher levels. This is potentially an excessive burden on these less than strong credits, who had to seek these secured loans out rather than hit the bond market, given their size and weak credit to begin with. All of which means that there is more and more concern that higher defaults in that area of credit is on the horizon. Given that, we continue to avoid those types of structures and issuers who rely on that type of lending in their portfolios, such as REITS and BDCs. Long-time residents on our avoid list, we remain wary of the sectors as we contemplate a less than soft landing moving forward.

- Agency MBS remains a favored sector. We continue to find value in pools with certain characteristics that we feel will capture upside in expected rate environments. Furthermore, certain other pools provide upside possibilities, if the fear of a hard landing and steep economic pullback results. The Fed’s efforts to reduce its balance sheet, either through maturities or sells, muddies the picture a bit, introducing choppiness to the market, and bank demand, which waned toward the end of year 2022 is always something to keep in mind when contemplating future performance of the sector. Nevertheless, with historic movements in terms of the basis widening, value seems available to help capture potential future over-performance. We continue to see value in multiple segments of the market and continue to prefer pools with low extension risk if refinance incentives remain stagnant or we witness a housing market downturn. Examples of recent purchases are investor property collateral pools and shorter duration pools composed of the less traditional 10-year mortgages.

- Heavy ABS new issuance continues to be available. With only a short 3 day hiatus due to the industry conference, primary issuance has been robust and better yet, met with solid demand. Deals continue to tighten, albeit slowly, as the industry adapts to wider spread levels, with those deals needing to widen their offering spread levels beyond initial pricing thoughts more the anomaly than those deals that tested and tightened final levels. Reversing a recent trend, used car pricing has increased, which is encouraging data for legacy auto ABS, which continues to support our view that auto ABS presents great value. We continue to monitor legacy deals, especially those in 2022 for weakness due to how much rates might be impacting borrowers, but thus far, deal structures have held strongly. We continue to prefer more liquid, older types of ABS with historical performance such as auto, credit card, and equipment leasing. Newer asset types such as unsecured consumer lending, such as LendingTree or SOFI are avoided, given their limited experience going through an economic downturn. Whole business securitization, including data centers and franchise loans are avoided due to limited investor bases and illiquidity.

- Bad news in the commercial real estate sector is now seemingly a daily occurrence. Previously office properties came under scrutiny due to changes in the workforce and companies no longer needing space for the larger contingent of employees who want to work at home. Recently, business travel lodging joined the concerns, as less business travel has resulted in occupancy rates remaining subdued on those properties who relied on that customer segment. The risk is multi-pronged given the ripples from commercial real estate as a whole, but while certain segments remain under duress we also remain wary of deals that were issued not only in CMBS but CRE, or those that contained large exposures to mezzanine financing. As we have mentioned, there is a large tail risk to the sector, and if the economic environment does move into recession area, we’d expect even more stress in the area. We continue to view commercial real estate as a sector to avoid near-term.

- Investment grade corporate credit remains attractive. We continue to find value in the higher grade of credit, and focus on shorter maturities, given the rate environment. High yield promises higher and higher yields, but for those credits that fall out of favor, the market punishes them quickly and liquidity becomes an issue. We find far more value in investment grade than high yield at this time. Furthermore, we remain more interested in newer issuance given liquidity profile and defensive sectors. As a result, we continue to focus on liquid names, and prefer more defensive sectors such as packaging. We do remain alert, however, for best in class names in sectors currently being discounted, such as aircraft leasing and telecommunications.

- Hybrids continue to provide opportunities for over-performance. Newer deals, with stronger liquidity profiles in high quality bank names are preferred over other sectors, including most corporates which remain heavily tested liquidity-wise in the wrong environment. Baby bonds have gained some degree of support of late, however, we continue to avoid those versions of hybrids, given pricing seems to be more correlated to the equity markets and liquidity can be scarce when needing to sell large blocks. Legacy hybrids, or those that have advanced past their fixed coupon to floating rate, have less appeal. The floating liability structure would seem to have appeal in this rate environment, however, liquidity is less appealing given those tend to be older in terms of vintage and there is more upside performance to be found in the newer issues. Bank names remain our preferred targets, including some strong Yankee bank names that offer more yield given their overall credit strength versus weaker domestic banks.

Positioning & Outlook

Fear of the Fed returned strongly during the month. More importantly, we saw some hedging and headlines indicating that some alternative managers and banks were not eager to hedge against 6% terminal rates. With some banks raising their expectations to a 5.5% to 5.75% terminal rate. The step-ups in this regard means the bond market seems to be capitulating to the Fed. And that gives the Fed some confidence to act as they see fit. Nevertheless, we do expect a slowing of rates at some point. There is an end in sight. Furthermore, we do expect data will ultimately catch-up and rate fears to slowly dissipate again. Leaving the back half of the year, to a potential rate rally.

Last month the overall mood in the fixed income market was a positive one. This month, definitely more subdued and an underlying feeling of fear of the Fed building. Nonetheless, primary markets remain robust and secondary trading has been supportive of strong overall market liquidity. As we have the last few months, we remain committed to sticking to higher credit quality while targeting specific issuers and sectors to help lay a foundation for potential future over-performance. The shorter end of the yield curve, where the Fed has been focused on attacking, is the most opportunistic spot to target, and we find most value in the 1-3 year area of the curve. Duration remains at or near most recent levels and we expect it to stay in the area for the near-term.

We continue to be selective and patient with cash. Weeding out credits we feel have fully realized value, and using the environment to shift the portfolio to take advantage of what we feel will be future opportunities once the noise from the Fed fades. We feel comfortable targeting certain issuers, sectors and maturities to reach optimum weightings which we feel will lay a foundation for possible near-term over-performance.

Learn more about the Yorktown Short Term Bond Fund:

Definition of Terms

Basis Points (bps) - refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Curvature - A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Mortgage-Backed Security (MBS) - A mortgage-backed security is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

Collateralized Loan Obligation (CLO) - A collateralized loan obligation is a single security backed by a pool of debt.

Commercial Real Estate Loan (CRE) - A mortgage secured by a lien on commercial property as opposed to residential property.

CRE CLO - The underlying assets of a CRE CLO are short-term floating rate loans collateralized by transitional properties.

Asset-Backed Security (ABS) - An asset-backed security is an investment security—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables

Option-Adjusted Spread (OAS) - The measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Enhanced Equipment Trust Certificate (EETC) - One form of equipment trust certificate that is issued and managed through special purpose vehicles known as pass-through trusts. These special purpose vehicles (SPEs) allow borrowers to aggregate multiple equipment purchases into one debt security

Real Estate Investment Trust (REIT) - A company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors.

London InterBank Offered Rate (LIBOR) - a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Secured Overnight Financing Rate (SOFR) - a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR).

Delta - the ratio that compares the change in the price of an asset, usually marketable securities, to the corresponding change in the price of its derivative.

Commercial Mortgage - Backed Security (CMBS) - fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Floating-Rate Note (FRN) - a bond with a variable interest rate that allows investors to benefit from rising interest rates.

Consumer Price Index (CPI) - a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Gross Domestic Product (GDP) - one of the most widely used measures of an economy's output or production. It is defined as the total value of goods and services produced within a country's borders in a specific time period—monthly, quarterly, or annually.

Perp - A perpetual bond, also known as a "consol bond" or "perp," is a fixed income security with no maturity date.

Nonfarm payrolls (NFPs) - the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications. This is measured by the federal Bureau of Labor Statistics (BLS), which surveys private and government entities throughout the U.S. about their payrolls.

Net Asset Value (NAV) - represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.

S&P 500 - The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

German DAX - The DAX—also known as the Deutscher Aktien Index or the GER40—is a stock index that represents 40 of the largest and most liquid German companies that trade on the Frankfurt Exchange. The prices used to calculate the DAX Index come through Xetra, an electronic trading system.

NASDAQ - The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.

MSCI EM Index - The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei - The Nikkei is short for Japan's Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Shanghai Composite - is a stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange.

Bloomberg U.S. Agg - The Bloomberg Aggregate Bond Index or "the Agg" is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

MOVE Index - The ICE BofA MOVE Index (MOVE) measures Treasury rate volatility through options pricing.

VIX Index - The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

Dow Jones Industrial Average - The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Hang Seng - The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

STOXX Europe 600 - The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Euro STOXX 50 - The EURO STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within eurozone nations.

CAC (France) - is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse).

Duration Risk - the name economists give to the risk associated with the sensitivity of a bond's price to a one percent change in interest rates.

Federal Open Market Committee (FOMC) - the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMO).

United States Treasury (UST) - the national treasury of the federal government of the United States where it serves as an executive department. The Treasury manages all of the money coming into the government and paid out by it.

High Yield (HY) - high-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Investment Grade (IG) - an investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Exchange Traded Fund (ETF) - an exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock.

Federal Family Education Loan Program (FFELP) - a program that worked with private lenders to provide education loans guaranteed by the federal government.

Business Development Program (BDC) - an organization that invests in small- and medium-sized companies as well as distressed companies.

Job Opening and Labor Turnover Survey (JOLTS) Report - is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

Sifma - The Securities Industry and Financial Markets Association (SIFMA) is a not-for-profit trade association that represents securities brokerage firms, investment banking institutions, and other investment firms.

Disclosures

You should carefully consider the investment objectives, potential risks, management fees, charges and expenses of the fund before investing. The fund's prospectus contains this and other information about the fund and should be read carefully before investing. You may obtain a current copy of the fund's prospectus by calling 800-544-6060.

Per the most current prospectus, (1) Fund total operating expense ratios are: Class A, 0.87%; Class L, 1.52%; Institutional Class, 0.87% until at least May 31, 2023. (2) In addition, the Adviser has entered into contractual expense limitation agreement with the Trust so that the Fund’s ratio of total annual operating expenses are limited to 0.84% for Class A shares and Institutional Class shares and 1.49% for Class L Shares until at least May 31, 2023.

Fixed income investments are affected by a number of risks, including fluctuation in interest rates, credit risk, and prepayment risk. In general, as prevailing interest rates rise, fixed income securities prices will fall.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. There is no guarantee that this, or any, investing strategy will succeed.

Diversification does not ensure a profit or guarantee against loss.

There is no affiliation between Ultimus Fund Distributors, LLC and the other firms referenced in this material.

Control #: 16629785-UFD-3/20/2023