Macroeconomic Update

The first quarter of 2023 came to a close as March brought unexpected shock (and eventual calm) to financial markets. The month began with participants expecting the regular tug of war between the Federal Reserve and the familiar monthly economic data releases. With the yield curve at its most inverted level since 1981 (-92 bps on March 6th) and eyes on other recessionary indicators, investors prepared for jobs data on the 10th (still fairly strong), the CPI release on the 14th (still relatively hot), and the Fed meeting on the 22nd (25 bps hike with cautious guidance). Jerome Powell spoke on the 7th with a hawkish message, warning that the inflation fight “has a long way to go and is likely to be bumpy.” Two days later the focus shifted materially.

Silicon Valley Bank (SVB), with north of $200b in assets and which serviced about half of venture-backed tech in Silicon Valley, had a big problem. The bank had taken in huge amounts of deposits in recent years (totaling nearly $130b in 2020 and 2021) and had put much of this cash to work in government securities (Treasuries and Agency MBS). These holdings, while offering guaranteed return of principal, took severe mark-to-market losses as interest rates rapidly rose beginning in late 2021. On the 8th of March, the bank’s parent company revealed a loss of $1.8b on a sale of $21b of securities and stated it would initiate an equity capital raise to compensate for the loss. SVB’s clients panicked and effectively incited a bank run, with attempts by depositors to withdraw $42b in a single day. The FDIC quickly took over the insolvent institution and days later First Citizens BancShares announced it would acquire SVB.

U.S. regulators stated that SVB customers would be backstopped. Nonetheless, following the largest bank collapse since the 2008 financial crisis, fears of contagion and systemic risk in the banking system spread quickly, as investors worried over mark-to-market losses in bank portfolios and possible depositor panic. Some alarm ensued following the turmoil with Signature Bank, First Republic Bank, and even Credit Suisse (CS). In the case of CS, the Swiss National Bank had to provide liquidity support to calm markets. On March 17th, UBS announced it was in talks to acquire all or part of CS. Meanwhile, several large U.S. banks came together to help rescue First Republic. Investors awaited more bad news in the form of potential regional bank failures, but regulators calmed markets. And critically, markets began to agree on consensus that banks are far better capitalized than they were in 2007 and 2008, and our understanding of financial stability has improved substantially in the last 15 years.

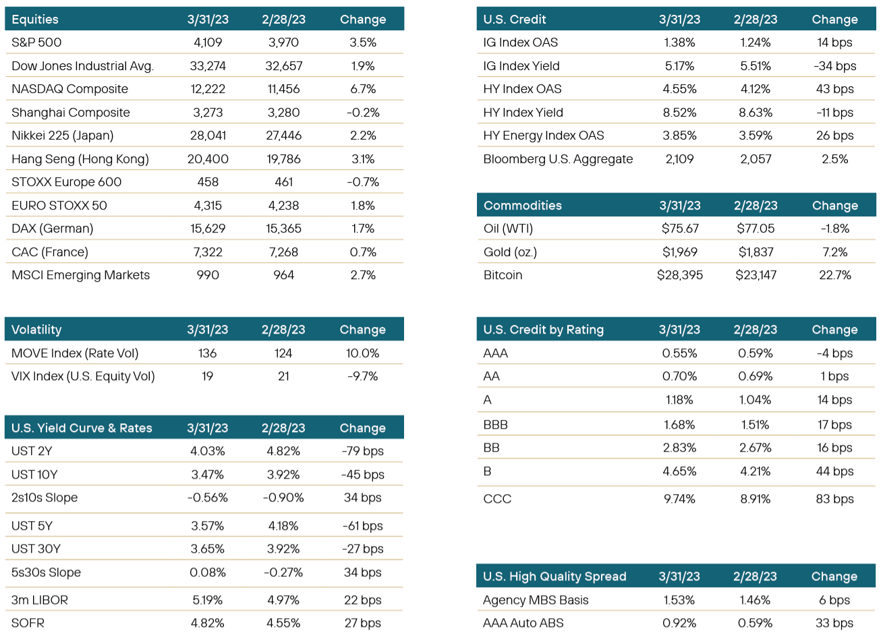

Markets saw extraordinary volatility over the month but a late-month calm produced rallies in many risk assets. Equities finished higher and the 2Y UST moved lower by 79 bps month-over-month, and while risk spreads widened on net, most of the larger moves were in the lowest parts of the credit stack. Changes in investment grade product were relatively benign. The big question that now emerges, assuming bank stability, is whether this crisis will effectively do much of the Fed’s work for it. Asset price deflation leads naturally to deleveraging and tightening credit, which can be big components of the formula the Fed needs to lower inflation.

Portfolio Review

March was all about fear and loathing. Punctuated by the quick demise of Silicon Valley Bank (SVB), the market did what it seems it is really good at in this age of social media: react quickly to rumors and don’t bother to ask questions. To be sure SVB’s seemingly overnight collapse should have been something on most radars, given the rapid rise in rates and the holdings in those baskets that are not necessarily marked to market, once a security is introduced to sale out of that basket, the outcome isn’t going to be pretty. Right after that it became an exercise in how social media can fan the flames and stir up panic, forcing every bank to have to defend itself. To be sure, SVB’s portfolio and risk management was lacking. What SVB did, however, was once again reset the tone in the credit markets. It was a junior version of what happened during the Great Financial Crisis (GFC). However, despite how much it seemed certain bad actors wanted to recreate the GFC, the government, regulators, and more importantly, other banks stepped up and quickly stomped out the fire before it became all encompassing. Nevertheless, damage done. And more importantly, opportunity began to knock. As is most of the cases in times like this, an ability to be resilient in the face of those trying to shake cheap securities loose from you or better yet, having the dry powder to be a buyer in that moment, creates opportunities to build future over-performance.

Issuance fell to a crawl post-SVB. With the credit spreads widening and investors hunkering down, no issuer wanted to take the plunge. Later in the month, one of the stronger names in the market, Duke Energy, stepped up and took the chance at new issuance. With the successful reopening of the market, others began dipping their toes in the waters. However, the slowdown of issuance did affect pretty much all asset types and sectors including corporates and asset-backed securities, who even postponed some deals. Secondary trading was more robust, with opportunities available to pick up wider spreads abundant. Nevertheless, for the majority of the market, especially high yield and investment grade funds, many were forced to be more sellers than buyers as they dealt with outflows.

Fear of the Fed dissipated in a nanosecond. With the credit concerns in the banking sector, suddenly the market started to see a huge rally in the front end of the curve. The assumption was that the Fed might even postpone the upcoming rate hike, preferring to stand pat. However, many market participants were concerned that would send more fear rippling through the market and in the end, the FOMC did what seemed to be a balancing act. They still hiked rates 25 bps, soothing some concern in the market that would have fed on the thought the Fed knew more trouble was brewing, and still staying on the path to fighting inflation. All in all, it now seems that some of the anecdotal evidence of a slowing economy is coming to fruition and as such, the market now is no longer fearful of a terminal rate above 5% for the 2 year and is now in fact pricing in rate cuts coming as soon as July. The idea being that the credit issues at the banks is in itself deflationary and with tighter credit now being exhibited, taking some of the go-go out of the economy. In essence, the banking credit concerns, leading to tighter credit restrictions trickling down to borrowers and consumers is basically doing the Fed’s work for them.

Noted asset sector target or bias this month includes:

- Mortgage spreads took an understandably volatile path in the month of March with several large selloffs along with intense periods of tightening. Spreads overall finished 5 to 10 bps wider during the month, but MBS dollar prices actually finished well positive due to lower rates. 30Y 4.0 and 5.0 coupon bonds posted gains in the vicinity of a point and a half. We continue to find MBS attractive with spreads near the wides of their historic ranges. Implied rate volatility tends to be one of the largest drivers of mortgage spread performance, and while volatility may not abate in the near term, mortgages offer enough carry in the meantime to wait out some of the volatility. We like good convexity profiles in newer issues as well as the opportunity to add seasoned bonds at discounts that are guaranteed to mature at par.

- Corporates broadly provide opportunity. We continue to pare high yield exposures, as we anticipate a slowing economy in the near-term and prefer the more liquid investment grade credit space. Within corporates, we remain focused on defensive sectors such as utilities, packaging, and discount retailers which tend to do well in a slower economy. Of late, some value has been released in airlines leasing bonds, which contain a quasi-corporate exposure secured by specific aircraft. Those bonds with a sinking fund feature and the secured aspect tend to provide over-performance opportunities at a discount price.

- Energy continues to have a moment with OPEC announcing unexpected production cuts. Midstream and Exploration & Production credits have rallied over the past several months. We continue however to avoid the sector. With a potential slowdown in economic activity on the horizon, and tightening bank credit, we would expect volatility and credit pressures to return in the fossil fuel sub-sector. Interestingly enough it doesn’t appear that the sub-sector has used this time of low volatility and higher profit margins to rebuild balance sheet strength. Rather, stock buybacks are typically more the norm. Renewable energy continues to be a focus of the current administration, helping that area of the energy sector gain momentum, and recent developments in Europe, which has used some combination of renewable energy and alternative outlets to wean itself off Russian oil dependence, provides further evidence of renewables gaining ground. We continue to prefer the green energy/renewable sub-sector of energy.

- ABS primary issuance experienced a pause due to the bank sector issues. Similar to other sectors, it saw some spread widening. However, secondary trading was robust, especially in Auto Asset Backed Securities, which further illustrated the strength of its liquidity over other ABS sectors. The 2022 vintages continue to show some weakness, as loans originated during that period of time seem to be under-performing. On the positive side, used car prices remain strong and servicers/sponsors of transactions have exhibited plenty of support for their trusts. With a near-term expectation of economic slowdown, we continue to avoid sub-sectors like unsecured consumer lending, which due to the age of that sector has not been subjected to economic conditions we expect to see. As a result, we remain concerned that performance in those sectors could suffer far more than modeled expectations. We continue to prefer ABS in the secondary markets to that of new issuance, as we like older vintages with several months of supporting performance to analyze prior to purchase. We expect the liquid sectors we have long preferred to continue to show strength and performance upside as we move into a different economic phase.

- Perpetuals were impacted a great deal by the banking sector stress. Specifically we saw spread widening in those European bank issuances known as AT1 or CoCos, once Credit Suisse had its issues. The market seemed to over-react, with a lack of understanding of the instruments’ place in the capital structure and the capital ratio benefits of those securities. Within the space, we continue to prefer exposures to systemically important banks and those staid, boring Yankee banks who are typically the ones the regulators turn to when looking for strong partners to help out the weak. With spreads moving wildly, however, we have moved to a more neutral outlook on the sector as we wait for some calm and spreads to snap back.

Positioning & Outlook

The month started off with some positive momentum, only to get thrown in a tailspin due to SVB and Credit Suisse. However, as noted, the Fed might see the benefits of bank tightening credit standards and pulling back on offering credit, causing a deflationary influence on the markets and helping the Fed do its job. As such, we would expect to see some rate rallies in the near-term, some slowing down in Fed actions, and ultimately in the second half of the year, potential rate cuts. We remain committed to sticking to higher credit quality while targeting specific issuers and sectors to help lay a foundation for future over-performance. The importance of diversification and liquidity were evident in the short-term and we expect more of that in the near-term. The front-end of the curve remains the most opportunistic area for investment targets, and we still feel we find most value in the 1-3 year area of the curve. Duration remains at or near most recent levels and we expect it to stay in the area for the near-term.

We have used conditions to continue adding to positions we like, and when possible, targeting opportunities we had been patiently waiting for. Deployment of cash remains steady and opportunistic. Targets include those issuers, sectors and maturities we feel will help reach optimum weightings that ultimately could lead to near-term over-performance.

Learn more about the Yorktown Multi-Sector Bond Fund:

Definition of Terms

Basis Points (bps) - refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Curvature - A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Mortgage-Backed Security (MBS) - A mortgage-backed security is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

Collateralized Loan Obligation (CLO) - A collateralized loan obligation is a single security backed by a pool of debt.

Commercial Real Estate Loan (CRE) - A mortgage secured by a lien on commercial property as opposed to residential property.

CRE CLO - The underlying assets of a CRE CLO are short-term floating rate loans collateralized by transitional properties.

Asset-Backed Security (ABS) - An asset-backed security is an investment security—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables

Option-Adjusted Spread (OAS) - The measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Enhanced Equipment Trust Certificate (EETC) - One form of equipment trust certificate that is issued and managed through special purpose vehicles known as pass-through trusts. These special purpose vehicles (SPEs) allow borrowers to aggregate multiple equipment purchases into one debt security

Real Estate Investment Trust (REIT) - A company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors.

London InterBank Offered Rate (LIBOR) - a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Secured Overnight Financing Rate (SOFR) - a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR).

Delta - the ratio that compares the change in the price of an asset, usually marketable securities, to the corresponding change in the price of its derivative.

Commercial Mortgage - Backed Security (CMBS) - fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Floating-Rate Note (FRN) - a bond with a variable interest rate that allows investors to benefit from rising interest rates.

Consumer Price Index (CPI) - a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Gross Domestic Product (GDP) - one of the most widely used measures of an economy's output or production. It is defined as the total value of goods and services produced within a country's borders in a specific time period—monthly, quarterly, or annually.

Perp - A perpetual bond, also known as a "consol bond" or "perp," is a fixed income security with no maturity date.

Nonfarm payrolls (NFPs) - the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications. This is measured by the federal Bureau of Labor Statistics (BLS), which surveys private and government entities throughout the U.S. about their payrolls.

Net Asset Value (NAV) - represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.

S&P 500 - The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

German DAX - The DAX—also known as the Deutscher Aktien Index or the GER40—is a stock index that represents 40 of the largest and most liquid German companies that trade on the Frankfurt Exchange. The prices used to calculate the DAX Index come through Xetra, an electronic trading system.

NASDAQ - The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.

MSCI EM Index - The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei - The Nikkei is short for Japan's Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Shanghai Composite - is a stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange.

Bloomberg U.S. Agg - The Bloomberg Aggregate Bond Index or "the Agg" is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

MOVE Index - The ICE BofA MOVE Index (MOVE) measures Treasury rate volatility through options pricing.

VIX Index - The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

Dow Jones Industrial Average - The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Hang Seng - The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

STOXX Europe 600 - The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Euro STOXX 50 - The EURO STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within eurozone nations.

CAC (France) - is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse).

Duration Risk - the name economists give to the risk associated with the sensitivity of a bond's price to a one percent change in interest rates.

Federal Open Market Committee (FOMC) - the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMO).

United States Treasury (UST) - the national treasury of the federal government of the United States where it serves as an executive department. The Treasury manages all of the money coming into the government and paid out by it.

High Yield (HY) - high-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Investment Grade (IG) - an investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Exchange Traded Fund (ETF) - an exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock.

Federal Family Education Loan Program (FFELP) - a program that worked with private lenders to provide education loans guaranteed by the federal government.

Business Development Program (BDC) - an organization that invests in small- and medium-sized companies as well as distressed companies.

Job Opening and Labor Turnover Survey (JOLTS) Report - is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

Sifma - The Securities Industry and Financial Markets Association (SIFMA) is a not-for-profit trade association that represents securities brokerage firms, investment banking institutions, and other investment firms.

You should carefully consider the investment objectives, potential risks, management fees, charges and expenses of the fund before investing. The fund's prospectus contains this and other information about the fund and should be read carefully before investing. You may obtain a current copy of the fund's prospectus by calling 1-800-544-6060.

Per the most recent prospectus, the operating expense ratios for the Yorktown Multi-Sector Bond Fund are as follows: Class A, 1.11%; Class L, 1.61%; Class C, 1.61%; Institutional Class, 0.61%. The Fund does not use fee waivers at this time.

Fixed income investments are affected by a number of risks, including fluctuation in interest rates, credit risk, and prepayment risk. In general, as prevailing interest rates rise, fixed income securities prices will fall.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. There is no guarantee that this, or any, investing strategy will succeed.

Diversification does not ensure a profit or guarantee against loss.

There is no affiliation between Ultimus Fund Distributors, LLC and the other firms referenced in this material.

Control #: 16748658-UFD-4/17/2023