Macro Update

Markets faced a challenging month across asset classes, with equities lower, rates higher, and spreads wider. Treasury rates reached their highest levels since 2007 on worries that investors will need to be positioned for rates to remain elevated for a while even after the Federal Reserve ends its hiking cycle. While hopes for a soft landing have never been higher, the August rate selloff commenced immediately, initially sparked by Fitch’s downgrade of the U.S. to AA+ on the first of the month. From there, the markets began navigating a month with sparse liquidity yet filled with economic data.

Nonfarm payrolls came in at +187k versus a 200k expectation, but average hourly earnings came in hot at 4.4% - a figure unwelcome to the Fed. With a good enough headline number and some prior month revisions, yields rallied a bit, with the report seen as being soft enough. Consumer Price Index (CPI) on the 10th was largely what economists expected, and it wasn’t much of a market catalyst, as it did not suggest any realistic change to the Fed’s policy path. Some even better data followed as year-ahead inflation expectations fell surprisingly, as did the short-term view of inflation, which reached its lowest point since March 2021.

Nonetheless, despite JPMorgan and Bank of America calling for a soft landing and some concerns for potential contagion from China’s economic situation, yields continued to sell off. One driver was the Fed minutes on the 16th, which indicated that most officials continue to see upside inflation risks that could warrant further tightening. Another has been the better-than-expected recent economic data, and with growth not expected to fall off, longer-dated Treasury and Treasury Inflation-Protected Securities (TIPS) yields have moved higher. Recession odds have diminished, and large Federal deficits are expected to continue increasing the supply of Treasury debt. This, coupled with an eye on the path of inflation, has contributed to the highest UST yields in over 15 years.

As we got later into the month, we caught a few Treasury rallies on the backs of some weaker economic data. The Bureau of Labor Statistics stated that nonfarm payroll growth may be revised downward, and investors have noted that higher recent yields have pushed up mortgage and corporate borrowing rates, creating some induced financial tightening. Meanwhile, the Jackson Hole Symposium was not terribly eventful, aside from reinforced notions of holding policy restrictive for longer. Boston Fed President Susan Collins stated that incremental tightening is not off the table as the economic “resilience really does suggest we may have more to do.” Inflation is not quite yet viewed as being on a sustainable lower trajectory. Meanwhile, in his speech, Chair Powell said the Fed will proceed carefully on whether to hike again, and persistent above-trend growth could lead to tightening, while also mentioning that there may still be significant further drag from past hikes.

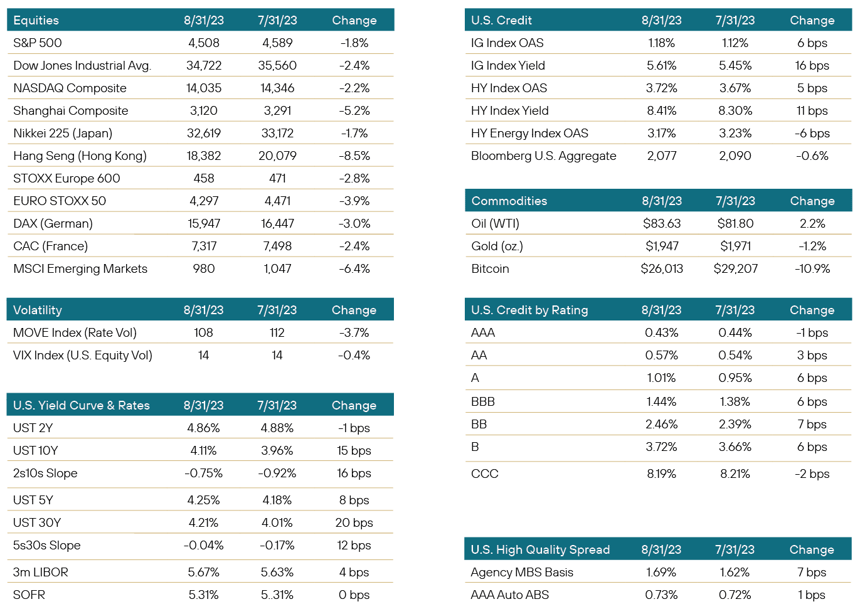

Rates did finish the month with some positive momentum. On the 29th, the short end of the yield curve rallied substantially as U.S. job openings fell in July by more than expected – to a two-plus year low. Nonetheless, for the month, the 10Y and 30Y Treasuries sold off by 15 bps and 20 bps, and the 2s-10s curve bear steepened by 16 bps.

Portfolio Review

Consensus is building that the Fed will indeed stand pat at its next meeting in September. Despite that expectation, rates remain fairly volatile, albeit trading within a band that incorporates those expectations. Additionally, market pundits who foresee a soft landing for the economy are becoming more vocal, and that type of consensus also seems to be building, becoming a more popular stance and what to expect from the economy in the near term. Economists at large banks have also been shifting their views on the subject, and we are aware more and more through published research that those banks’ recession expectations are dwindling in terms of percentage possibilities, with Goldman Sachs recently, for instance, modifying their stance to the point where they now put recession possibilities at around 15%. While the economy’s strength is overall good news, it causes some concerns in the capital markets as market players grapple with how likely the Fed will continue to pause if the economy continues to show strength. This can all cause some unwanted volatility in the market as participants dissect each data point, and as before, this leads us to conclude that maintaining a consistent outlook and steady near-term and longer-term viewpoint may ultimately lead to overperformance.August is typically a quiet month, with vacations and lighter desk participation more the norm. Nevertheless, we have seen enough market participation and data to remain confident in our viewpoint that patience is needed. As we stated before, remaining committed to an overall near-term outlook and riding out the bumps is helping in terms of identifying targets and creating future opportunities that will ultimately help create an environment for potential overperformance.

Noted asset sector target or bias this month includes:

- MBS have been hit hard by the bear steepening in yields since midsummer. Spreads have widened, and mortgages have underperformed on a hedge-adjusted basis. The FDIC passthrough liquidations from this spring’s banking issues finally ended on August 30, which should help MBS find its footing a bit. Our view remains that the longer-term investment profile for MBS is attractive. Spreads are still wide from relative value and historical standpoints, and we believe that the current level of interest rates offers substantial long-term performance potential for rate-driven products. Higher coupon securities at attractive valuations offer sufficient carry to weather the intermediate-term market volatility in MBS. We like low payup conventionals and slightly seasoned discounts. We also believe payups in 20Y product have room to appreciate and offer relative return, whereas 15Y fixed looks a little tight right now.

- Commercial real estate remains an avoid. With mortgage rates high and a slowdown in the CMBS market, refinancing seems to be complicated. With balloon payments looming and available space for lease climbing, there doesn’t seem to be a lot of positive trends in the space. Office space remains a concern as despite some uptick in companies pushing employees back to the office; those remain the exception rather than the rule. Furthermore, retail, which had shown a nice upside of late, might be looking at near-term issues if the consumer stumbles, as we expect. Given all of those factors, we feel further pressure on the overall space is highly likely and worse, especially exposures found in older CMBS.

- ABS remains a preferred sector, but we see more upside in segments such as equipment leasing and seasoned secondary paper in auto ABS. Equipment leasing has seen a rush of new, primary deals, making the paper suddenly more in demand. As such, spread tightening has occurred. Newer issue auto ABS has had some performance issues of late, and we therefore prefer older, more seasoned paper. In both cases, paper has a strong liquidity profile and upside performance available, and we prefer the higher rated, more senior tranches and stepping up in credit. There seems to be more performance upside and tightening available in those classes. Esoteric ABS remains a concern, with a very small investor base and limited liquidity available.

- Preferreds and hybrids move to a more neutral sector. Post-March bank sell-off, spread widening had made it an attractive sector. However, spreads have retraced most of what they lost in March, and while there remains some untapped value on a name-by-name basis, the sector overall seems closer to being fairly priced. We continue to prefer the bigger domestic banks and larger yankee banks, and still feel there is some overperformance available in new issue. We would expect, going forward, an uptick in issuance in the space as larger issues are nearing their call dates. Those will present some upside opportunities. However, secondary paper overall seems to be tight with limited future upside available.

- BDCs are also an avoid. Despite corporate health overall being considered relatively strong, the lower pockets of credit are showing some wear and tear. Worse, we see research and anecdotal evidence that those reliant on one-off secured loans, the sweet spot for most BDC targets, are starting to see an uptick in terms of defaults. We remain wary of the space and feel recent underwriting, as well as reps and warranties, in those loan deals, might not be the strongest and foresee future issues down the road. If corporates are to start to see some strain, we would expect it to manifest first in this area.

Positioning & Outlook

The shift toward a soft landing, which we have seen building over the past few months in terms of expectations, continues to help support credit spreads. However, the support and tightening aren’t as sharp as one would expect, and we continue to hear enough anecdotal evidence that we remain a bit more skeptical of the overall economic strength, especially as it appears in terms of jobs. More and more information appears to illustrate that the consumer might be running out of gas, and similar to last month, we remain cautious about embracing certain segments that are more closely correlated to consumer confidence and spending. For those segments such as consumer discretionary, we continue to be more neutral to avoid as we target issuers and focus on further data points such as loan reserves and bank provisions for clues as to what to expect moving forward. We are content to be more neutral and let those potential worries play out before aggressively returning to those sectors. With yields at levels not seen in years, we are content to be less aggressive in terms of credit and await further data to help shape our future expectations.

Liquidity in fixed income remains strong overall. The primary market has been robust, with several deals announced daily across many sectors, being printed with multiples in terms of over-subscription levels on each deal. This is a hearty primary market, and with it would appear multiple levels of demand. Even more sensitive names and sectors seem to have a welcoming audience. Secondary trading is not quite as robust. ABS appears to be more active in terms of secondary trading than that of corps, and there is still a higher liquidity premium than one would expect in such a solid primary market. We would assume that says more about levels of cash being available for investors and more likely investors are selling older vintages to buy the newer deals rather than using cash they hoarded over the summer.

Despite the rosy outlooks from bank research and economists, we continue to prefer a more conservative approach and remain positioned for a slower economy. There seems to be more upside in being more conservative than worrying about the sharper downside if the more upbeat outlooks don’t occur. The focus remains on credit, liquidity, and diversification as a means to mitigate whatever shift we might witness as we move into the third quarter and on. The front end of the curve remains the most opportunistic area for investment targets, and we still feel we find the most value in the 1 to 3-year area. Duration has moved out a bit, but it is still near the most recent levels, and we expect it to stay in that area for the near term.

Learn more about the Yorktown Short Term Bond Fund:

Definition of Terms

Basis Points (bps) - refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Curvature - A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Mortgage-Backed Security (MBS) - A mortgage-backed security is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

Collateralized Loan Obligation (CLO) - A collateralized loan obligation is a single security backed by a pool of debt.

Commercial Real Estate Loan (CRE) - A mortgage secured by a lien on commercial property as opposed to residential property.

CRE CLO - The underlying assets of a CRE CLO are short-term floating rate loans collateralized by transitional properties.

Asset-Backed Security (ABS) - An asset-backed security is an investment security—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables.

Option-Adjusted Spread (OAS) - The measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Enhanced Equipment Trust Certificate (EETC) - One form of equipment trust certificate that is issued and managed through special purpose vehicles known as pass-through trusts. These special purpose vehicles (SPEs) allow borrowers to aggregate multiple equipment purchases into one debt security

Real Estate Investment Trust (REIT) - A company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors.

London InterBank Offered Rate (LIBOR) - a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Secured Overnight Financing Rate (SOFR) - a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR).

Delta - the ratio that compares the change in the price of an asset, usually marketable securities, to the corresponding change in the price of its derivative.

Commercial Mortgage-Backed Security (CMBS) - fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Floating-Rate Note (FRN) - a bond with a variable interest rate that allows investors to benefit from rising interest rates.

Consumer Price Index (CPI) - a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Gross Domestic Product (GDP) - one of the most widely used measures of an economy's output or production. It is defined as the total value of goods and services produced within a country's borders in a specific time period—monthly, quarterly, or annually.

Perp - A perpetual bond, also known as a "consol bond" or "perp," is a fixed income security with no maturity date.

Nonfarm payrolls (NFPs) - the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications. This is measured by the federal Bureau of Labor Statistics (BLS), which surveys private and government entities throughout the U.S. about their payrolls.

Net Asset Value (NAV) - represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.

S&P 500 - The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

German DAX - The DAX—also known as the Deutscher Aktien Index or the GER40—is a stock index that represents 40 of the largest and most liquid German companies that trade on the Frankfurt Exchange. The prices used to calculate the DAX Index come through Xetra, an electronic trading system.

NASDAQ - The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.

MSCI EM Index - The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei - The Nikkei is short for Japan's Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Shanghai Composite - is a stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange.

Bloomberg U.S. Agg - The Bloomberg Aggregate Bond Index or "the Agg" is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

MOVE Index - The ICE BofA MOVE Index (MOVE) measures Treasury rate volatility through options pricing.

VIX Index - The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

Dow Jones Industrial Average - The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Hang Seng - The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

STOXX Europe 600 - The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Euro STOXX 50 - The EURO STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within eurozone nations.

CAC (France) - is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse).

Duration Risk - the name economists give to the risk associated with the sensitivity of a bond's price to a one percent change in interest rates.

Federal Open Market Committee (FOMC) - the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMO).

United States Treasury (UST) - the national treasury of the federal government of the United States where it serves as an executive department. The Treasury manages all of the money coming into the government and paid out by it.

High Yield (HY) - high-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Investment Grade (IG) - an investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Exchange Traded Fund (ETF) - an exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock.

Federal Family Education Loan Program (FFELP) - a program that worked with private lenders to provide education loans guaranteed by the federal government.

Business Development Program (BDC) - an organization that invests in small- and medium-sized companies as well as distressed companies.

Job Opening and Labor Turnover Survey (JOLTS) Report - is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

Sifma - The Securities Industry and Financial Markets Association (SIFMA) is a not-for-profit trade association that represents securities brokerage firms, investment banking institutions, and other investment firms.

Duration - A calculation of the average life of a bond (or portfolio of bonds) that is a useful measure of the bond's price sensitivity to interest rate changes. The higher the duration number, the greater the risk and reward potential of the bond.

Trust Preferred Securities (TruPS) - hybrid securities issued by large banks and bank holding companies (BHCs) included in regulatory tier 1 capital and whose dividend payments were tax deductible for the issuer.

Treasury Inflation-Protected Securities (TIPS) - are a type of Treasury security issued by the U.S. government. TIPS are indexed to inflation to protect investors from a decline in the purchasing power of their money. As inflation rises, rather than their yield increasing, TIPS instead adjust in price (principal amount) to maintain their real value. The interest rate on a TIPS investment is fixed at the time of issuance, but the interest payments keep up with inflation because they vary with the adjusted principal amount.

Disclosures

You should carefully consider the investment objectives, potential risks, management fees, charges and expenses of the fund before investing. The fund's prospectus contains this and other information about the fund and should be read carefully before investing. You may obtain a current copy of the fund's prospectus by calling 800-544-6060.

Per the most current prospectus, (1) Fund total operating expense ratios are: Class A, 0.92%; Class L, 1.57%; Institutional Class, 0.92% until at least May 31, 2024. (2) In addition, the Adviser has entered into a a contractual expense limitation agreement with the Trust so that the Fund’s ratio of total annual operating expenses are limited to 0.84% for Class A shares and Institutional Class shares and 1.49% for Class L Shares until at least May 31, 2024.

Fixed income investments are affected by a number of risks, including fluctuation in interest rates, credit risk, and prepayment risk. In general, as prevailing interest rates rise, fixed income securities prices will fall.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. There is no guarantee that this, or any, investing strategy will succeed.

Diversification does not ensure a profit or guarantee against loss.

There is no affiliation between Ultimus Fund Distributors, LLC and the other firms referenced in this material.

Control #: 17385066-UFD-9/14/2023