Macro Update

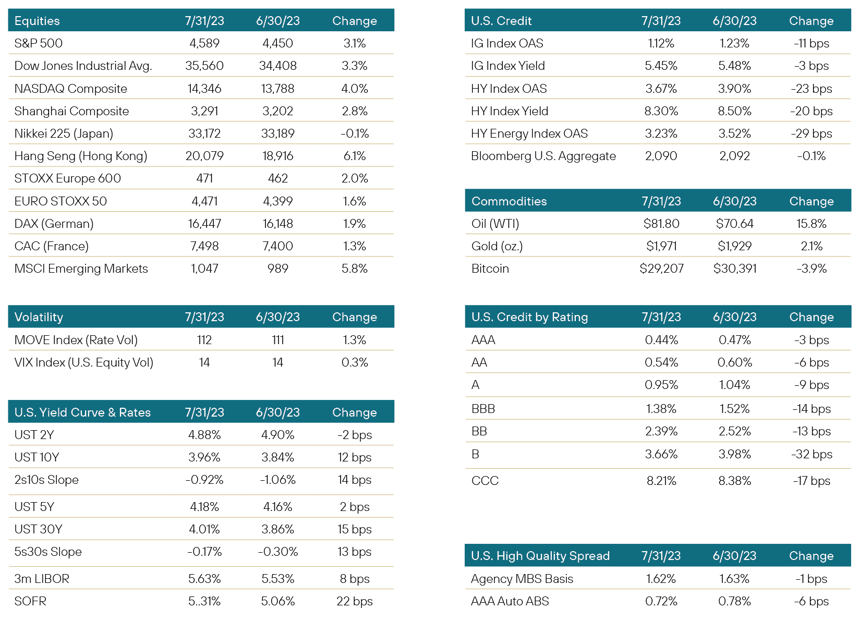

July was risk-on with equities and oil surging, Treasury rates moving higher, and credit spreads tightening. Investors followed the usual, winding course of economic data (plus a Fed meeting) and by month’s end, their belief in a soft-landing scenario had strengthened. Data was mixed, as it has been for some time, but it had a dovish bias in critical areas like inflation.

Setting the tone, the Fed minutes released in the first week of July suggested that while the central bank sees more rate hikes ahead, those hikes may come at a slower pace than many had interpreted at the previous meeting. Shortly after, we received an outsized ADP Research Institute employment number, driving a selloff in the 2Y UST back to 5%, only to be entirely overshadowed by a headline nonfarm payrolls number that beat expectations for only the second time in a year. While average hourly earnings were higher than hoped, and the unemployment rate and labor participation were unchanged, the market nonetheless rejoiced with a sharp rally in reaction to this just-ok Non-Farm Payroll (NFP) report. The message was loud and clear: the risk of economic overheating is lessening.

Hawkish Fed rhetoric didn’t seem to dull the market’s content with the jobs report, even with Mary Daly (President of the Federal Reserve Bank of San Francisco) saying “a few more hikes will be needed”, and Loretta Mester (CEO of Federal Reserve Bank of Cleveland) adding that those rates will need to stay restrictive for a while. In fact, the rates rally had another two legs to it, as July 12th and 13th brought favorable Consumer Price Index (CPI) and Producer Price Index (PPI) figures. CPI headline was 3.0% compared to a 3.1% forecast and core came in at 4.8% against an expectation of 5.0% (down from 5.3%). The month-over-month headline (0.2%) looked fine as well: higher than the previous but below expectation. As mentioned, PPI came in below target the next day, along with jobless claims that were read as ok.

Starting on the 14th, a reversal got underway in the Treasury market, driven by a two-year high in consumer sentiment and rising short-term inflation expectations. That being said, the possibility of a soft landing felt genuinely realistic. Meanwhile, the rate futures market backed off its call for late-2023 rate cuts, somewhat acknowledging that with CPI well above the typical 2% target, we’re just not going to see imminent cuts, barring the unforeseen.

On July 26th, as expected, the Fed hiked 25 bps to a 22-year high and left the door open for additional tightening. There were very few changes to the Fed’s statement, although it did upgrade growth expectations a touch. Chair Powell left options open for the September meeting. With two more jobs and CPI reports before the next meeting, the Fed has time to decide on whether to move higher on September 20th.

Three days later the Fed was glad to see its favored inflation gauge (June Core Personal Consumption Expenditures (PCE)) moderate both year over year and month over month. Along with cooling inflation, better-than-expected GDP was reported, consumer spending increased faster than income, and a solid corporate earnings season rounded out in July. Optimism has undoubtedly picked up regarding the economy’s ability to avoid a recession – and that the Fed’s hiking cycle may be complete. Of course, some will contend that a hard landing is simply delayed, as considerable consumer savings have been built up during the pandemic. Additionally, consumers also had quite a bit of time to lock in low pandemic-era interest rates into the future. It follows that rate hikes may only now just be starting to impact the consumer. We’ll all know a great deal more by late September.

Portfolio Review

There has been enough strength in the economic numbers to keep pushing the end of the rate hiking cycle further and further down the road. Or so it would seem. Nevertheless, by the end of the month, the Fed moved its Fed Funds target rate to 5.50% and expectations are that the Fed will pause at the next meeting. Although economic data at the end of the month exhibited enough strength to make some questions, there is a feeling that a pause will occur, and the Fed and the market seem to be getting a bit weary of the constant hiking. If the data cooperates going forward, and with it, some assurances that the hiking is down starting to soothe the market, we expect some rate rally in the future. Until that moment, however, every economic report is to be dissected and combed through with some trepidation in that it would force still more rate hikes. This is the type of environment where overperformance can be captured by utilizing a consistent outlook and approach when it comes to a rate viewpoint.

Credit continues to be an ongoing debate as well, with most pundits starting to shift opinions and expectations and now beginning to embrace the idea of a soft landing. However, we continue to view that idea warily as anecdotal evidence and enough headlines make us more cautious than most with our credit outlook. Squarely in our sightlines is the consumer. Jobs data continues to show strength, more robust than we would expect. As such, we continue to mine data indicating that the consumer remains on a firm footing. Any slippage here and the ripples are far-reaching. Consumer discretionary, banks, real estate, etc. are all areas to focus on as those which historically have suffered when the consumer is struggling. Those are large enough issues to cause a sudden widening of credit spreads and a drying up of credit with far-ranging implications. Our horizon for credit continues to narrow, as we don’t want to be caught off-sides if or when a shift occurs.

Noted asset sector target or bias this month includes:

- Agency MBS continues to be a preferred space. Dollar prices were mostly unchanged from the beginning to the end of July, as rates rallied and then sharply pulled back. Mortgage spreads moved little, exhibiting range-bound volatility. MBS spreads are still attractively wide from relative value and historical standpoints. Moreover, we feel the current level of interest rates offers substantial long-term performance potential for rate-driven products. We don’t expect any imminent, sudden rally given the holes in the MBS market from the lack of bank demand (no deposit growth) and the Fed’s lack of buying, but we like the product’s longer-term investment profile. Higher coupon securities at attractive valuations offer sufficient carry to weather the intermediate-term market volatility in MBS. We like low payup conventionals and slightly seasoned discounts. We also believe payups in 20Y products have room to appreciate and offer relative return, whereas 15Y fixed looks a little tight right now.

- Corporates have moved to a more neutral sector. With our credit viewpoint being focused on slippage in the consumer, we remain overall vigilant in watching for credit spread widening. Investment grade credit remains preferable to below investment grade, which we feel might widen out faster than expected if the market starts to turn against lesser credits. We still prefer more defensive sectors such as discounters in the retail and eatery space, as well as high liquidity sectors such as rail and utilities if we do add to our corporate exposure.

- ABS remains a preferred sector, with significant upside still available. However, with our focus on the consumer, there are specific sectors and vintages that would advocate for a more neutral approach. With the current confusion and push for student loan relief such a political hot potato, we prefer to keep current holdings but avoid adding to the sector. Likewise, we continue to like more seasoned auto paper but remain more neutral when it comes to new issue as we want to see how the consumer is affected going forward. We continue to like equipment leasing deals but would continue to avoid less liquid sectors such as whole business and data center deals, which we would expect to widen due to higher liquidity premiums. Value in the right deals and vintages is still available and thus, overall, we prefer secondary offerings to new issue.

- Preferreds and hybrids continue to be an attractive sector with still plenty of upside in the proper names after the March bank sell-off. Targeted big name, too big to fail, banks have recaptured most of their pricing. Still, with additional new issue from some of the bigger domestic and Yankee banks hitting the markets, it has added to the participation rate amongst investors. We continue to prefer the more prominent names in the space which still have upside. Other targets in the sector are those banks with differing revenue profiles, such as those focused on trust or administrative services which creates some diversification within the exposure bucket as well.

- Esoteric assets continue to be avoided. Whether the esoteric nature has to do with structure, or age in terms of issuance year, anything that looks a little different or has a “story” even in highly liquid names is to be avoided as well. This market quickly punishes the difference and liquidity remains a coveted characteristic.

Positioning & Outlook

With rates starting and stopping in terms of rallies or sell-offs, and our near-term concerns about credit, we remain neutral in terms of primary issuance. Overall liquidity in the market seems unchanged from last month whereby we noted adequate liquidity that can dissipate reasonably quickly in the wrong name or sector. Most participants have a similar outlook and seem content to let these next few Fed meetings and whatever is left of the summer countdown before entering the market again in any meaningful fashion.

With summer in full bloom, the market, as its cycle, has stepped back and activity shadows the times. It is a slower market typically in the summer regardless, and with the rates and credit confusing for many in the market, the preference is to stand pat. We continue to prefer a consistent outlook when it comes to rates and credit, and feel patience remains essential. Even in markets such as this, specific sectors do come out in terms of opportunities and preference, and by remaining patient and waiting for those opportunities, outperformance can potentially be had. We continue to prefer that approach and wait for our targeted opportunities to emerge.

We continue to position ourselves anticipating a slower economy, and while most are embracing the “soft landing” thesis, we prefer to be a little more conservative. We continue to do our best to remain mindful of rates, preferring a more neutral outlook than being hyper-aggressive to a call one way or the other. The focus remains on credit, liquidity, and diversification as a means to mitigate whatever shift we might bear witness to in the third and fourth quarters. The front end of the curve remains the most opportunistic area for investment targets, and we still feel we find the most value in the 1-3 year area of the curve. Duration remains at or near most recent levels and we expect it to stay in the area for the near term.

Learn more about the Yorktown Short Term Bond Fund:

Definition of Terms

Basis Points (bps) - refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Curvature - A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Mortgage-Backed Security (MBS) - A mortgage-backed security is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

Collateralized Loan Obligation (CLO) - A collateralized loan obligation is a single security backed by a pool of debt.

Commercial Real Estate Loan (CRE) - A mortgage secured by a lien on commercial property as opposed to residential property.

CRE CLO - The underlying assets of a CRE CLO are short-term floating rate loans collateralized by transitional properties.

Asset-Backed Security (ABS) - An asset-backed security is an investment security—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables.

Option-Adjusted Spread (OAS) - The measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Enhanced Equipment Trust Certificate (EETC) - One form of equipment trust certificate that is issued and managed through special purpose vehicles known as pass-through trusts. These special purpose vehicles (SPEs) allow borrowers to aggregate multiple equipment purchases into one debt security

Real Estate Investment Trust (REIT) - A company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors.

London InterBank Offered Rate (LIBOR) - a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Secured Overnight Financing Rate (SOFR) - a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR).

Delta - the ratio that compares the change in the price of an asset, usually marketable securities, to the corresponding change in the price of its derivative.

Commercial Mortgage-Backed Security (CMBS) - fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Floating-Rate Note (FRN) - a bond with a variable interest rate that allows investors to benefit from rising interest rates.

Consumer Price Index (CPI) - a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Gross Domestic Product (GDP) - one of the most widely used measures of an economy's output or production. It is defined as the total value of goods and services produced within a country's borders in a specific time period—monthly, quarterly, or annually.

Perp - A perpetual bond, also known as a "consol bond" or "perp," is a fixed income security with no maturity date.

Nonfarm payrolls (NFPs) - the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications. This is measured by the federal Bureau of Labor Statistics (BLS), which surveys private and government entities throughout the U.S. about their payrolls.

Net Asset Value (NAV) - represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.

S&P 500 - The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

German DAX - The DAX—also known as the Deutscher Aktien Index or the GER40—is a stock index that represents 40 of the largest and most liquid German companies that trade on the Frankfurt Exchange. The prices used to calculate the DAX Index come through Xetra, an electronic trading system.

NASDAQ - The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.

MSCI EM Index - The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei - The Nikkei is short for Japan's Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Shanghai Composite - is a stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange.

Bloomberg U.S. Agg - The Bloomberg Aggregate Bond Index or "the Agg" is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

MOVE Index - The ICE BofA MOVE Index (MOVE) measures Treasury rate volatility through options pricing.

VIX Index - The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

Dow Jones Industrial Average - The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Hang Seng - The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

STOXX Europe 600 - The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Euro STOXX 50 - The EURO STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within eurozone nations.

CAC (France) - is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse).

Duration Risk - the name economists give to the risk associated with the sensitivity of a bond's price to a one percent change in interest rates.

Federal Open Market Committee (FOMC) - the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMO).

United States Treasury (UST) - the national treasury of the federal government of the United States where it serves as an executive department. The Treasury manages all of the money coming into the government and paid out by it.

High Yield (HY) - high-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Investment Grade (IG) - an investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Exchange Traded Fund (ETF) - an exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock.

Federal Family Education Loan Program (FFELP) - a program that worked with private lenders to provide education loans guaranteed by the federal government.

Business Development Program (BDC) - an organization that invests in small- and medium-sized companies as well as distressed companies.

Job Opening and Labor Turnover Survey (JOLTS) Report - is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

Sifma - The Securities Industry and Financial Markets Association (SIFMA) is a not-for-profit trade association that represents securities brokerage firms, investment banking institutions, and other investment firms.

Duration - A calculation of the average life of a bond (or portfolio of bonds) that is a useful measure of the bond's price sensitivity to interest rate changes. The higher the duration number, the greater the risk and reward potential of the bond.

Trust Preferred Securities (TruPS) - hybrid securities issued by large banks and bank holding companies (BHCs) included in regulatory tier 1 capital and whose dividend payments were tax deductible for the issuer.

Disclosures

You should carefully consider the investment objectives, potential risks, management fees, charges and expenses of the fund before investing. The fund's prospectus contains this and other information about the fund and should be read carefully before investing. You may obtain a current copy of the fund's prospectus by calling 800-544-6060.

Per the most current prospectus, (1) Fund total operating expense ratios are: Class A, 0.92%; Class L, 1.57%; Institutional Class, 0.92% until at least May 31, 2024. (2) In addition, the Adviser has entered into contractual expense limitation agreement with the Trust so that the Fund’s ratio of total annual operating expenses are limited to 0.84% for Class A shares and Institutional Class shares and 1.49% for Class L Shares until at least May 31, 2024.

Fixed income investments are affected by a number of risks, including fluctuation in interest rates, credit risk, and prepayment risk. In general, as prevailing interest rates rise, fixed income securities prices will fall.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. There is no guarantee that this, or any, investing strategy will succeed.

Diversification does not ensure a profit or guarantee against loss.

There is no affiliation between Ultimus Fund Distributors, LLC and the other firms referenced in this material.

Control #: 17273897-UFD-8/16/2023