“I would give the greatest sunset in the world for one sight of New York’s skyline.”

- Ayn Rand

February is a short month in terms of days, but boy, do those days seem long. Here in the Northeast, February is a slippery bridge that leads toward the promise of the sun and the reward of warmer weather. Maybe a walk outside even and the possibility of not slipping on ice left over from a January snowstorm. New York City is filled with these slippery spots. Tourists tend to look up when they are in the City. They are enamored with the mammoth buildings. City natives, on the other hand, keep their heads down, knowing that ice landmines are everywhere. NYC streets are typically hot, even in the winter. I assume that is due to the immense amount of wires under the streets as well as the subway. But February is a cruel temptress; temperatures drop fast, and when you add the shadows of the buildings with the winter wind whistling through the canyons between those buildings, it makes it quite easy to quickly turn whatever snow might’ve melted into hidden icy patches. It’s a tough lesson for the uninitiated. One moment, you are casually window shopping on Fifth Avenue, and the next, you are looking at the undercarriage of a Halal Guys food truck. Yes, February is plenty long enough here in the Northeast.

The problem with the icy patch is that you just aren’t looking for it. You know it’s February. You are aware of the fact it snowed two months ago. That is certainly plenty of time for it to have melted. But this is the Northeast, and snow doesn’t just disappear. Well, not until May or so. Until then, there is this unseen or maybe underappreciated risk lurking. You know what snow looks like. You think you know where to look for it. You just aren’t quite ready for the fact that, weeks later, when the thought of that risk of slipping has dissipated, you run into the risk of that overnight ice. It’s a delayed risk, a secondary one, an afterthought to the original issue.

Someone recently asked me, if the commercial real estate market is so bad, why haven’t we seen the carnage just yet? It’s a fair point. Kind of. We, of course, have seen it. We see it every day in various ways, but we tend to be so focused on one metric or one headline, maybe depending on headlines is a better way of saying it, that we seem to lose sight of it and put it out of our minds. Maybe “we haven’t seen enough pain” would be the better response. Everyone is aware of it. We do get plenty of speeches on it, and even the Fed mentions it. We see plenty of articles, but nothing yet where everyone collectively sits up and says uh-oh. We haven’t had our Bear Stearns moment. Over the past few months, we have been witness to a variety of breadcrumbs. There have been articles about a large player in commercial real estate mailing keys in for specific properties here and there. A BlackRock here, a TPG there, a Deutsche Bank mention over there. It would seem like a one-off, but not the massive landslide of bad news one would expect, given all the commercial loans out there.

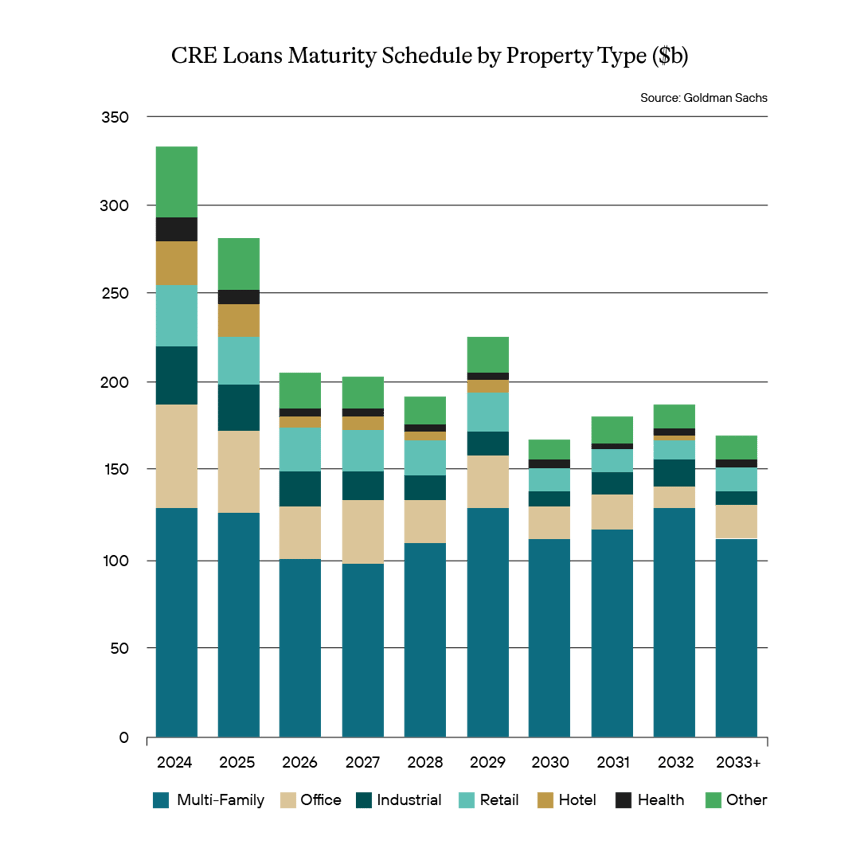

Rest assured, there are still a lot out there. There is a wall of maturities coming this way. As can be seen below, per Goldman Sachs, it’s not just the fact that there are a lot of commercial real estate (CRE) loans out there; it’s also that a great deal of those are coming for renewal in the next year or so. That is a lot to refinance into a market where rates are exceedingly high—so high as to make refinancing prohibitive.

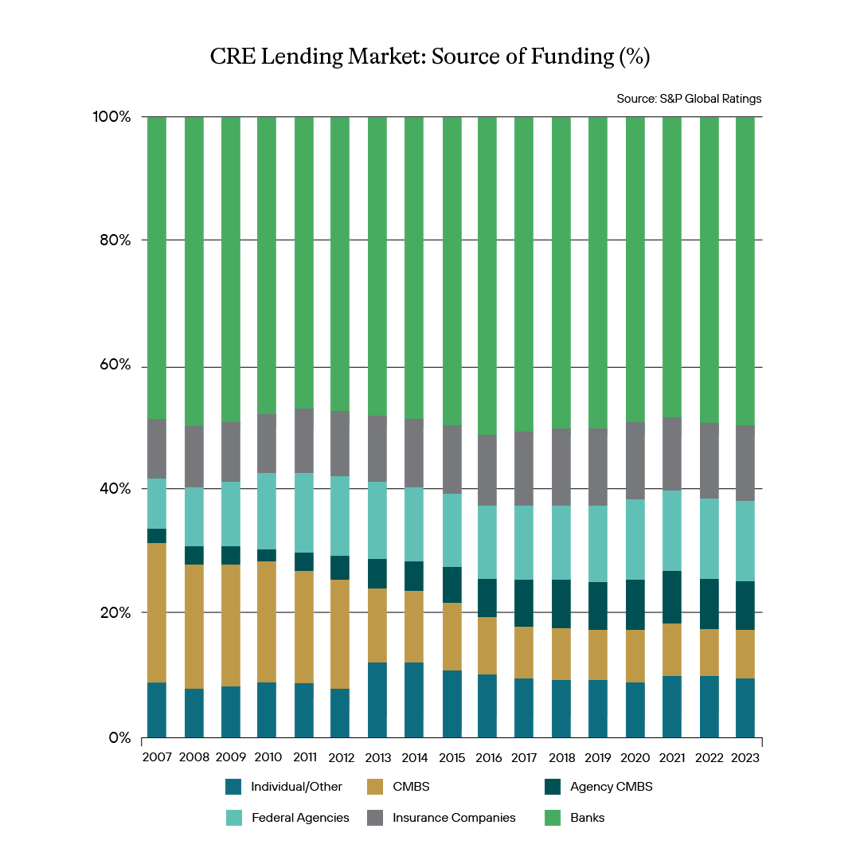

Worse, the original source of funding was mostly provided by banks. Indeed, according to S&P, roughly 50% of CRE loans in the past 15 years have been provided by banks. That is obviously pretty concentrated, especially when one considers the bulk of that exposure to be found in the smaller community banks and regional banks in the banking sector. The type of banks with limited funding profiles, less capital markets access, and currently faced with fighting for deposit money with a base more enamored with money market funds.

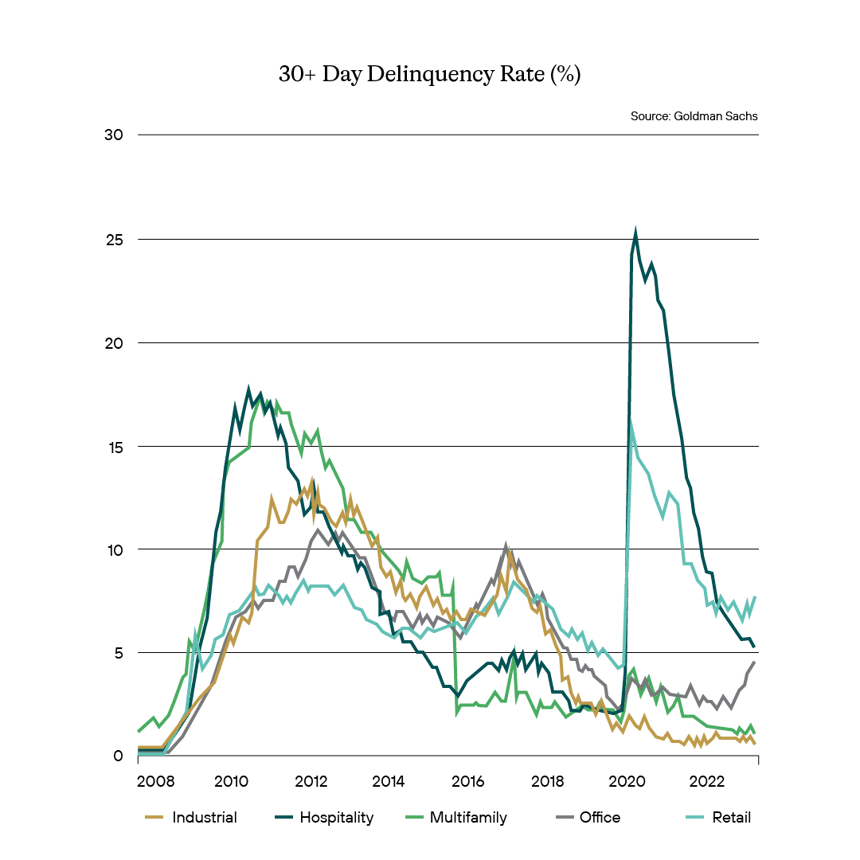

And, of course, we do know that poor performance is ongoing with no real slowdown in the velocity of delinquencies.

All of this brings us back to why we haven’t seen more fallout. Well, New York Community Bank gave us a good line of sight into why. And that is simply due to a lack of price discovery. That is, there just haven’t been enough properties selling to give any indication of where we are. Some of that is the way properties are valued and the way they are booked. There are certain investors who might book at purchase value, others mark them based on their valuations, and still others are private, so there is no insight to be had. But we haven’t seen enough actual transactions to give us a real indication of what type of fallout we should be expecting and what that means to the loans themselves, as well as securities backed by those loans. At least not enough to date. But we’re starting to see a trickle. New York Community Bank was a good start. Their selling of assets and taking a huge multi-billion charge for write-downs of acquisitions led to their pummeling.

So, as we start to see transactions, we would expect an acceleration of downward momentum for these banks. Many of the larger, better-capitalized banks have taken aggressive steps toward reserves in getting ready for the pummeling. The less sophisticated, smaller banks may be not so conservative, leaving themselves open to worse outcomes later.

We are pretty aware of all of that. Think of that as the initial snowstorm. And as we prepare with our salt for the roads and gas up our snow blowers, we kind of know it’s coming. However, what most are thinking too much of is, “What happens after the snow melts and reforms as ice?” That is, what is the secondary risk of this? Because most are focused on the banks. We have pondered secondary risk a little here, such as ancillary businesses like the local restaurants or retail outlets in these buildings. But there is actually a far bigger concern that is not really being talked about. What hasn’t been focused on enough is the fallout for the cities where these buildings reside, the stress to come due to tax shortages, and what that means to municipal budgets.

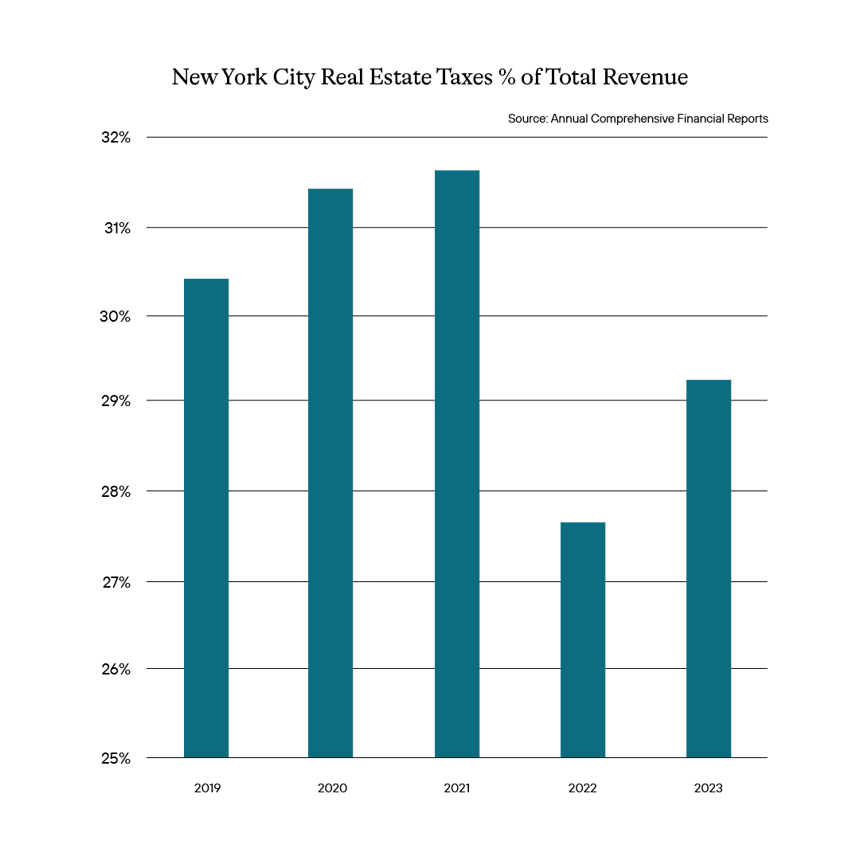

New York City is a solid place to start. Given the composition of its real estate market, office space is vastly important to not only the health of the market but the overall fiscal health of the City. According to NYC’s annual comprehensive financial reports, the City relies a great deal on real estate taxes for its tax revenue. In fact, for 2023, the City’s real estate taxes comprised over 29% of the total revenues for the City. With office space vacancies rising and valuations falling, this type of reliance on real estate taxes for revenue purposes is a concern. The City of New York is one of the biggest markets and has myriad issues that cause even bigger concerns in terms of fixing it. At the top of that list is a heavy burden from rent-stabilized buildings, which creates an impasse in raising rents even if the landlord wants to. Then comes the concern that if rents are raised, you will lose core or anchor tenants to more tenant-friendly terms at other buildings. And, of course, heavy regulations limit your ability or flexibility to repurpose the buildings from office to maybe residential space. While the rent stabilization issue tends to be more idiosyncratic to New York City, many of the other issues would have a similar result and thus burden for other large cities, which also are heavy issuers of municipal debt, such as Chicago, San Francisco, and Dallas.

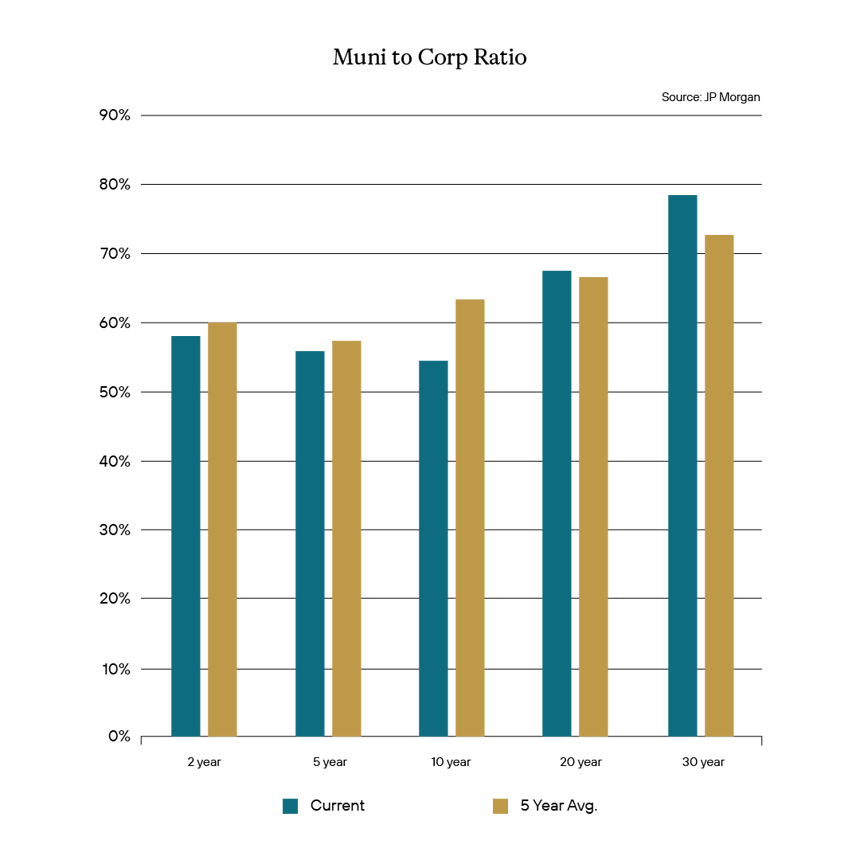

Investors, in turn, don’t seem to be paying that close of attention to this potential risk. How do we know that? Below is a chart detailing value in terms of municipal to corporate debt, which historically runs at certain percentages. That type of relationship is built over time and generally falls within certain boundaries depending on market conditions and investor risk appetite at different points in the cycle. Nevertheless, as can be seen when we look at 5-year averages, in many cases, we are at peak or overvaluation when considering the ratio. That would seem to indicate that overall municipal debt is relatively expensive compared to corporate debt – and at a time when we know corporate credit spreads are at tights.

The continued fallout from the CRE issues are going to continue to evolve over time. As more transactions occur and, thus, more price discovery occurs, we expect this to continue to weigh on the market. But right now, even that hasn’t pushed investors to the point where they seem to demand more reward for the upfront risk. We have witnessed that with the downward spiral of New York Community Bank, for which the third iteration of fallout hardly seemed to impact the banking sector at all. And if that is the response, one would imagine that secondary risk, the still unseen hidden ice, is not being appreciated enough at all.

One would suspect that current credit spreads are secondary for investors at this moment. Most seemingly are choosing to ignore spreads and are enamored with the higher rates and resulting coupons they are not able to invest in. And we seem to be seeing a similar pattern in municipals. The result may be a mispricing of risk and the appearance that investors don’t seem to be fully compensated for the risk being taken. Overall, this would indicate that if CRE does ultimately become more unconstrained - a very real possibility- then credits which are not immune to the ripples of such a massive market event, like municipals, may be affected. Investors in that sector could later look at the bottom of food trucks, totally confused about how they got there.

Definition of Terms

Basis Points (bps) - refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Curvature - A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Mortgage-Backed Security (MBS) - A mortgage-backed security is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

Collateralized Loan Obligation (CLO) - A collateralized loan obligation is a single security backed by a pool of debt.

Commercial Real Estate Loan (CRE) - A mortgage secured by a lien on commercial property as opposed to residential property.

CRE CLO - The underlying assets of a CRE CLO are short-term floating rate loans collateralized by transitional properties.

Asset-Backed Security (ABS) - An asset-backed security is an investment security—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables.

Option-Adjusted Spread (OAS) - The measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Enhanced Equipment Trust Certificate (EETC) - One form of equipment trust certificate that is issued and managed through special purpose vehicles known as pass-through trusts. These special purpose vehicles (SPEs) allow borrowers to aggregate multiple equipment purchases into one debt security

Real Estate Investment Trust (REIT) - A company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors.

London InterBank Offered Rate (LIBOR) - a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Secured Overnight Financing Rate (SOFR) - a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR).

Delta - the ratio that compares the change in the price of an asset, usually marketable securities, to the corresponding change in the price of its derivative.

Commercial Mortgage-Backed Security (CMBS) - fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Floating-Rate Note (FRN) - a bond with a variable interest rate that allows investors to benefit from rising interest rates.

Consumer Price Index (CPI) - a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Gross Domestic Product (GDP) - one of the most widely used measures of an economy's output or production. It is defined as the total value of goods and services produced within a country's borders in a specific time period—monthly, quarterly, or annually.

Perp - A perpetual bond, also known as a "consol bond" or "perp," is a fixed income security with no maturity date.

Nonfarm payrolls (NFPs) - the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications. This is measured by the federal Bureau of Labor Statistics (BLS), which surveys private and government entities throughout the U.S. about their payrolls.

Net Asset Value (NAV) - represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.

S&P 500 - The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

German DAX - The DAX—also known as the Deutscher Aktien Index or the GER40—is a stock index that represents 40 of the largest and most liquid German companies that trade on the Frankfurt Exchange. The prices used to calculate the DAX Index come through Xetra, an electronic trading system.

NASDAQ - The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.

MSCI EM Index - The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei - The Nikkei is short for Japan's Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Shanghai Composite - is a stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange.

Bloomberg U.S. Agg - The Bloomberg Aggregate Bond Index or "the Agg" is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

MOVE Index - The ICE BofA MOVE Index (MOVE) measures Treasury rate volatility through options pricing.

VIX Index - The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

Dow Jones Industrial Average - The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Hang Seng - The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

STOXX Europe 600 - The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Euro STOXX 50 - The EURO STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within eurozone nations.

CAC (France) - is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse).

Duration Risk - the name economists give to the risk associated with the sensitivity of a bond's price to a one percent change in interest rates.

Federal Open Market Committee (FOMC) - the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMO).

United States Treasury (UST) - the national treasury of the federal government of the United States where it serves as an executive department. The Treasury manages all of the money coming into the government and paid out by it.

High Yield (HY) - high-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Investment Grade (IG) - an investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Exchange Traded Fund (ETF) - an exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock.

Federal Family Education Loan Program (FFELP) - a program that worked with private lenders to provide education loans guaranteed by the federal government.

Business Development Program (BDC) - an organization that invests in small- and medium-sized companies as well as distressed companies.

Job Opening and Labor Turnover Survey (JOLTS) Report - is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

Sifma - The Securities Industry and Financial Markets Association (SIFMA) is a not-for-profit trade association that represents securities brokerage firms, investment banking institutions, and other investment firms.

Duration - A calculation of the average life of a bond (or portfolio of bonds) that is a useful measure of the bond's price sensitivity to interest rate changes. The higher the duration number, the greater the risk and reward potential of the bond.

Home Equity Line of Credit (HELOC) - A home equity line of credit (HELOC) is a line of credit that uses the equity you have in your home as collateral.

Government-Sponsored Enterprise (GSE) - A government-sponsored enterprise (GSE) is a quasi-governmental entity established to enhance the flow of credit to specific sectors of the U.S. economy. Created by acts of Congress, these agencies—although they are privately held—provide public financial services.

Qualified Mortgage (QM) - A qualified mortgage is a mortgage that meets certain requirements for lender protection and secondary market trading under the Dodd-Frank Wall Street Reform and Consumer Protection Act, a significant piece of financial reform legislation passed in 2010.

Trust Preferred Securities (TruPS) - hybrid securities issued by large banks and bank holding companies (BHCs) included in regulatory tier 1 capital and whose dividend payments were tax deductible for the issuer.

Control #: 17994134-UFD-03202024