“The best things in life come in threes, like friends, dreams, and memories.”

- Mencius

The summer has finally arrived. I know this because while my drive to the coffee shop is much shorter due to the fact I don’t have any local school commuters to deal with, the line at the coffee shop is now much more crowded with those school kids who are now out on summer break. In fact, as I stood in line for coffee the other morning for nearly 5 minutes, I realized that I was suddenly very much enthusiastically in favor of having year-round school if it would simply shorten my wait time in that line. But summer is here, and with it, besides the blistering sun’s rays, the beginning of a slowing down in the investment space as colleagues hit the vacation trail. There is still the matter of a Fed hike to deal with, maybe two, but we seem to finally see the end of that coming.

Given the slight pull back in frenzy that the market typically provides in other seasons, the summer can be a good time to clean things up; take a step back, regroup; and revisit strategy for the stretch run. As such, this month I thought we’d take a look at some things we are paying attention to. Not sure Mencius had it right when he said the “best things” because in fixed income we tend to look at things with less optimism, but these are three things on our mind.

Friends

Throughout this cycle with interest rates rising there was an assumption we would see a step back in spending, a cooling economy etc. Certainly, one would expect with higher interest rates, spending would slow. But that didn’t or hasn’t happened. Consumer spending has been resilient. Some of this no doubt can still be attributed to leftover frustrated pandemic-stoked demand. Some, maybe the majority, simply can’t help ourselves; we love to spend. Magnified by the fact that we look around and see friends finally getting that car they ordered a year ago, other friends heading to their new beach house, and still other friends heading out on dream vacations.

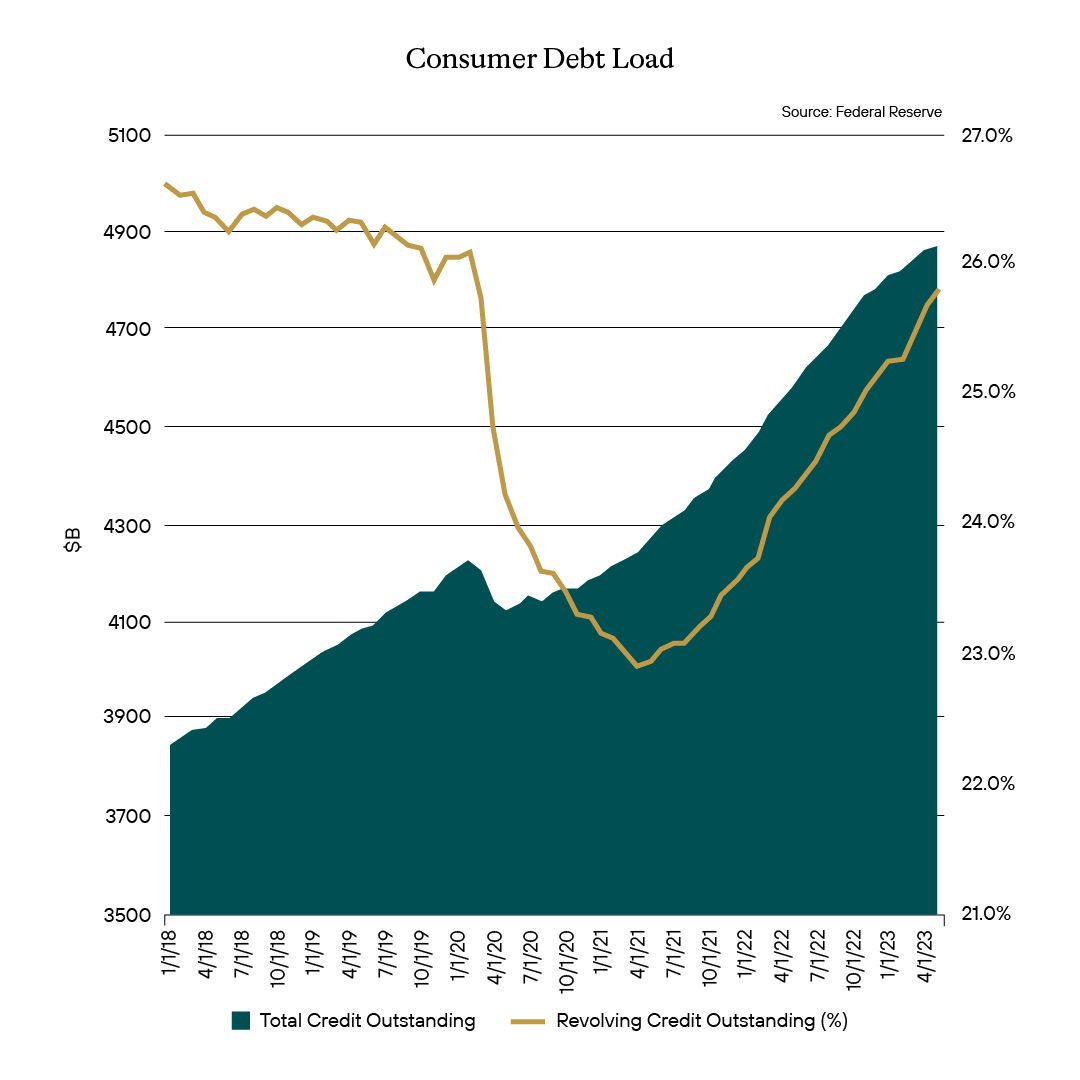

But what friends, and just about anyone around us, seem to be doing is doing all of this on the back of credit. Because the only thing as a nation we like to do more than spend, is seemingly spend now and pay later. This is illustrated below. The total revolving and nonrevolving amount of outstanding household debt keeps rising. By the end of May, it was reported by the Federal Reserve as reaching some $4.9 trillion, with a larger and larger percent of that debt being accumulated by utilizing revolving credit such as credit cards. In fact, revolving credit was reported as comprising some 26% of the total debt load in households, up from around 23% about two years ago. In other words, revolving debt has increased during a time of interest rate hikes. During this time, according to the Federal Reserve, auto loans, non-revolving credit, has moved from an average of around 5.0% to 7.5%, but rates on outstanding credit card debt, revolving credit, has moved from 14.2% to 20.1%.

The overall rise in consumer debt itself is worrisome. The fact we are doing so using more and more revolving credit is especially concerning. Assuming a slowing economy is in our near future and with it, a softening jobs market, that could lead to trouble for consumers. Trouble that would result in higher delinquencies and defaults on outstanding debt. Which of course leads to things such as a tightening of credit by banks and a pull back in lending, as well as potential for heightened credit concerns around those same banks. Not to mention the myriad of other issues and ripples, and what that would mean for the rest of the financial markets. Without delving too deeply into those ripples, the pressure on the consumer is sure something to pay attention to as one maps out future investment targets.

Dreams

We have all sorts of dreams. The trick is to make sure the dream doesn’t turn into a nightmare. Money market funds (MMFs) are living through that very scenario right now. MMFs were in a pleasant enough dream; current conditions were ideal, rates were rising, and they were seeing their AUM grow on a daily basis. Ah but then the regulators came knocking. As anyone who has been involved in the sector can attest, MMFs are seemingly always under the microscope, and for good reason. The product itself is sold as a stable value (although now their NAVs on credit MMFs float) and low volatility. But, as we have seen in market crisis after market crisis, these funds quickly turn from being safe havens to where market risk suddenly manifests itself. The slightest pressure, especially one wrapped around credit, can cause an immediate run on those funds, and create a massive issue with multiple worrisome ripples across the financial markets. The SEC and the market learned those lessons the hard way during the Great Financial Crisis, and all parties are on high alert for the next one every time the market gets a little wonky. Indeed, during the early days of the pandemic, pressures in the sector caused enough angst that it had the regulators re-examining them again.

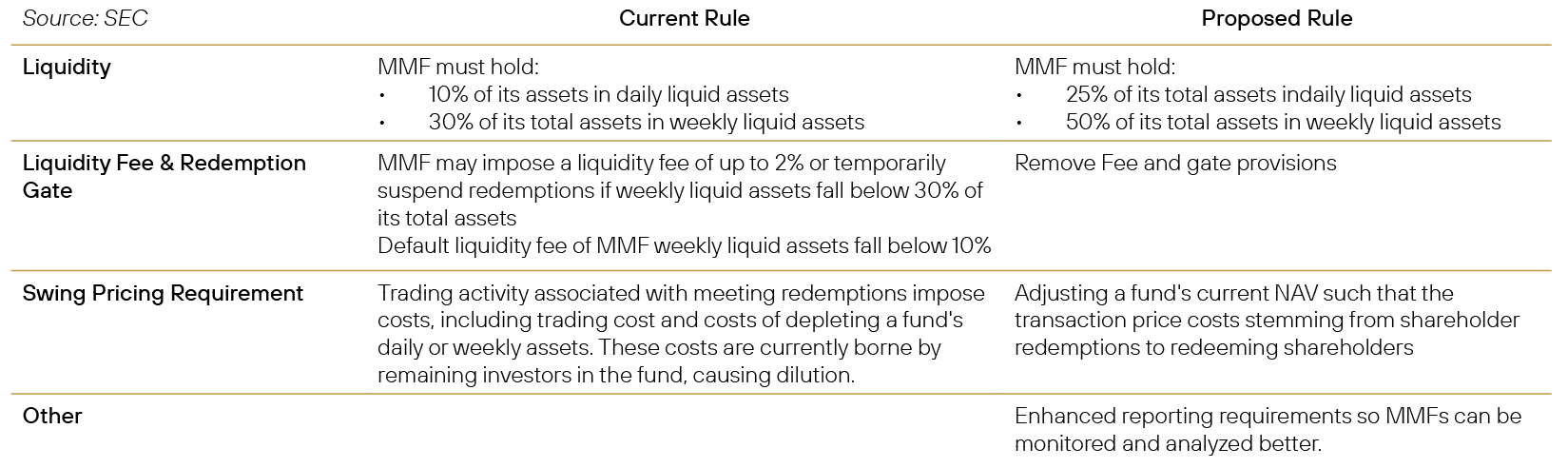

The result of this examination: regulators are planning on more money market reform. Below are the current rules being considered and the proposed reforms to those rules.

In certain cases, such as the liquidity fee and redemption gate, the regulators are reversing reforms they put in place the last time there was a crisis. Which would indicate that those reforms didn’t quite work in the way they thought they would. Not super inspiring. Of the new reforms being considered, the one that piques our interest is the first one: Liquidity. Under current regulations, MMFs are required to hold 10% of their total assets in daily liquid assets and 30% in weekly liquid assets. The proposed reform will increase the daily liquid assets to a required 25% and weekly liquid assets would be now required to be 50% minimum.

That is a notable shift. One of the biggest issues with MMFs overall, and a reason for a concern that they might cause a run is that over time enough reforms have occurred, coupled with industry consolidation, that these funds tend to invest in the same things. Thus, if one fund has an issue, all seem to have an issue. The increased requirements of higher percentage of liquid assets will further cement that. There are limited number of issuers in the front end to begin with, and by forcing everyone to increase the liquid assets bucket, you’d force them to the same issuers, limiting diversification possibilities. The response I would expect is that prime or credit MMFs will turn to more government debt and most likely become bigger users of such things as repo and the Fed’s reverse repo facility. This will certainly cause a reverse in terms of yield. Once rate hikes stop, I would expect front end yields to fall-off pretty quickly. Part of that will be of course the rates themselves, but additional decrease in yield will be the result of the new reforms. By boxing everyone in under these suggested liquidity rules, it will create increased demand for the products they are all going to want to invest in, which will further compress yields on the front end tighter and tighter.

The front end of the yield curve is an important aspect for the health of the capital markets. Issuers need access to this funding for a variety of reasons. Anything that leads to issues in this area of the curve, skewing funding options for those issuers and the availability of credit on the front end of the curve, is something definitely worth paying attention to.

Memories

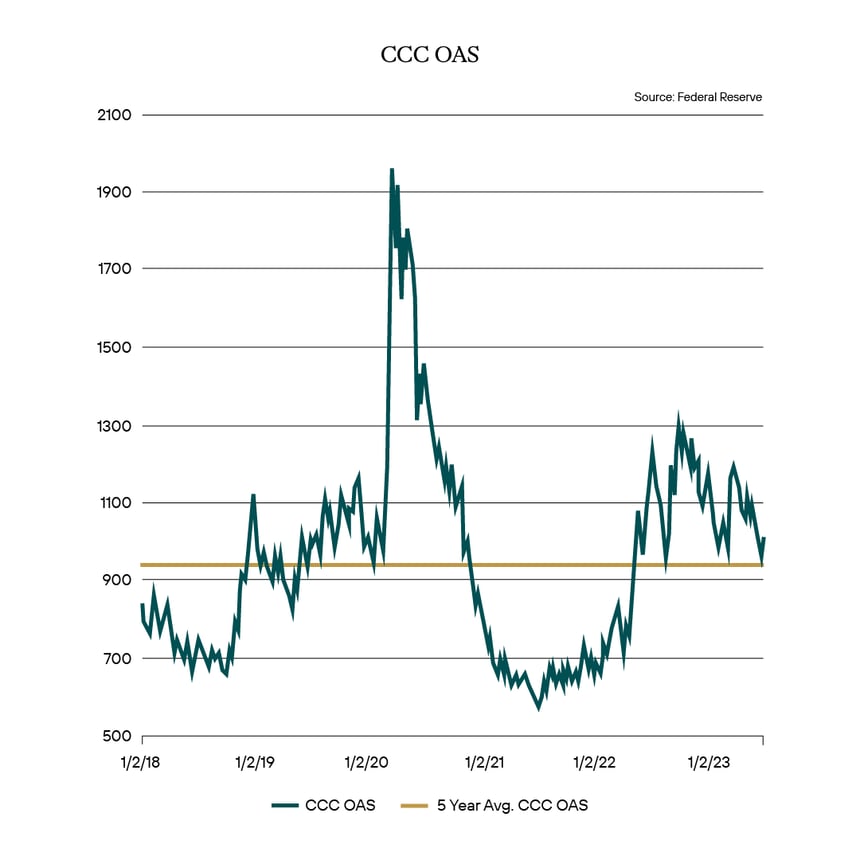

Can’t have a short memory if you’re gonna play in high yield. You have to accept that companies in this area of the credit stack are there for a reason, especially when you are talking CCC credit. Most of the time the reason they live in the CCC part of the credit world isn’t necessarily by choice. A tick up to even single B can result in much savings when it comes to financing, so certainly a worthy aspiration. We tend to monitor this area of the credit arena for clues to what the future holds for corporate credit. Movements in credit spreads can occur quickly down in this area and serve as a good first warning that things could be unraveling faster than those at the top of the corporate credit sector, those in the investment grade space, might be appreciating.

Of the more recent past, one would have pretty pleasant memories of this area of credit. During the low rate environment, issuers in this area were desired by investors, who, hungry for any kind of yield, would reach for what they felt would be the “better” CCC credits. As a result, as can be seen below, Options Adjusted Spreads (OAS) tightened well below their 5 year averages. However, once the rate hike cycle started, investors didn’t feel the need to reach anymore and so demand lessened. As a result, issuers in this area were faced with increasing financing costs, putting a strain on their overall credit health. As a result, spreads once again widened.

Since the beginning of the new year, however, spreads have started to tighten a little and are now right around the 5-year average. So within current expectations. Nevertheless, we pay close attention for any changes. With an understanding that bad news in terms of credit will start at the bottom of the credit stack and work its way up, we remain vigilant for any signs of widening credit spreads. We don’t need a long memory to know how fast bad news like that can work its way up the credit stack.

It may be summer, but beyond just the Fed, we do have a number of things that we like to watch. The three mentioned above gives us certain types of insights into market activity and help us shape strategy for what we feel the future will bring. None by themselves is necessarily a shining light of concern, but rather all present a picture of what we feel impact the markets in different areas and help us navigate the future in terms of allocations, investment targets, and liquidity. Being able to plan for the future and navigate efficiently certainly can help lead us to identifying and taking advantage of opportunities in the future.

Definition of Terms

Basis Points (bps) - refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Curvature - A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Mortgage-Backed Security (MBS) - A mortgage-backed security is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

Collateralized Loan Obligation (CLO) - A collateralized loan obligation is a single security backed by a pool of debt.

Commercial Real Estate Loan (CRE) - A mortgage secured by a lien on commercial property as opposed to residential property.

CRE CLO - The underlying assets of a CRE CLO are short-term floating rate loans collateralized by transitional properties.

Asset-Backed Security (ABS) - An asset-backed security is an investment security—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables

Option-Adjusted Spread (OAS) - The measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Enhanced Equipment Trust Certificate (EETC) - One form of equipment trust certificate that is issued and managed through special purpose vehicles known as pass-through trusts. These special purpose vehicles (SPEs) allow borrowers to aggregate multiple equipment purchases into one debt security

Real Estate Investment Trust (REIT) - A company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors.

London InterBank Offered Rate (LIBOR) - a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Secured Overnight Financing Rate (SOFR) - a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR).

Delta - the ratio that compares the change in the price of an asset, usually marketable securities, to the corresponding change in the price of its derivative.

Commercial Mortgage - Backed Security (CMBS) - fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Floating-Rate Note (FRN) - a bond with a variable interest rate that allows investors to benefit from rising interest rates.

Consumer Price Index (CPI) - a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Gross Domestic Product (GDP) - one of the most widely used measures of an economy's output or production. It is defined as the total value of goods and services produced within a country's borders in a specific time period—monthly, quarterly, or annually.

Perp - A perpetual bond, also known as a "consol bond" or "perp," is a fixed income security with no maturity date.

Nonfarm payrolls (NFPs) - the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications. This is measured by the federal Bureau of Labor Statistics (BLS), which surveys private and government entities throughout the U.S. about their payrolls.

Net Asset Value (NAV) - represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.

S&P 500 - The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

German DAX - The DAX—also known as the Deutscher Aktien Index or the GER40—is a stock index that represents 40 of the largest and most liquid German companies that trade on the Frankfurt Exchange. The prices used to calculate the DAX Index come through Xetra, an electronic trading system.

NASDAQ - The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.

MSCI EM Index - The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei - The Nikkei is short for Japan's Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Shanghai Composite - is a stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange.

Bloomberg U.S. Agg - The Bloomberg Aggregate Bond Index or "the Agg" is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

MOVE Index - The ICE BofA MOVE Index (MOVE) measures Treasury rate volatility through options pricing.

VIX Index - The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

Dow Jones Industrial Average - The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Hang Seng - The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

STOXX Europe 600 - The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Euro STOXX 50 - The EURO STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within eurozone nations.

CAC (France) - is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse).

Duration Risk - the name economists give to the risk associated with the sensitivity of a bond's price to a one percent change in interest rates.

Federal Open Market Committee (FOMC) - the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMO).

United States Treasury (UST) - the national treasury of the federal government of the United States where it serves as an executive department. The Treasury manages all of the money coming into the government and paid out by it.

High Yield (HY) - high-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Investment Grade (IG) - an investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Exchange Traded Fund (ETF) - an exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock.

Federal Family Education Loan Program (FFELP) - a program that worked with private lenders to provide education loans guaranteed by the federal government.

Business Development Program (BDC) - an organization that invests in small- and medium-sized companies as well as distressed companies.

Job Opening and Labor Turnover Survey (JOLTS) Report - is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

Sifma - The Securities Industry and Financial Markets Association (SIFMA) is a not-for-profit trade association that represents securities brokerage firms, investment banking institutions, and other investment firms.

Duration - A calculation of the average life of a bond (or portfolio of bonds) that is a useful measure of the bond's price sensitivity to interest rate changes. The higher the duration number, the greater the risk and reward potential of the bond.

Control #: 17156145-UFD-7/20/2023