“I’m saving my sick days for when I’m feeling better.”

- Salma Hayek

Things change over time. Not exactly news, I know, but lots of things change. Some things change in a small manner, some are major shifts, and some impact the very fabric of how we go about our daily lives. Coca-Cola changed their formula at one point during my lifetime. In hindsight that seems insane, but it also seemed a big deal at the time. It didn’t change our lives much though. One of the smaller things I’ve witnessed change over time has been how we dress at work. When I started my career, the men were in suits and ties and the women were in pantsuits; very formal. But over time, that began to shift and in most of cases had to do with competition; employers had to compete for workers. During the dotcom era, investment banks were fearful of losing valued employees to the very casual/informal work environment at internet startups and suddenly started to allow employees to change their work dress requirements. At first, it was just a Friday’s thing, business casual Fridays. Once that threat went away, job openings dropped and the banks were no longer worried about losing employees, suits came roaring back as a requirement. We’ve come a long way since then, and now business casual is more than normal. I like to think about that moment and what a simple shift in wardrobe requirement meant. As an employee, I found it far easier to dress in suits and ties. Keep to the basics of blue or white shirts, etc. Once we moved to business casual, my wardrobe became more expansive, and ultimately I found it to be more costly. Nevertheless, it caused a pretty big change in the financial sector in New York City in terms of retail stores and men’s clothing. Not a huge ripple, but certainly a noticeable one simply on how the work force now dressed and the types of offerings local clothiers had to offer. That is a far simpler example, but similar to what we are witnessing in terms of the workforce. This time though, the ripples are much, much bigger. In this case, it revolves around not what we wear to work, but where we work.

The pandemic we all made it through obviously caused some major shifts in the way we live. In many cases, it changed the very fabric of society, resulting in multiple ripples across the various ways we simply go about our daily lives. In some cases, the changes were relatively short-lived. Certainly, travel is a good example of that. Travel went from historic highs in terms of people flying, to almost zero in the midst of the pandemic; now we seem to be racing toward a return toward those previous highs. But one thing the pandemic really taught us is that maybe, just maybe, you don’t have to be in the office all the time to be productive. Work from home started out as a necessity borne out of the pandemic fallout, but since then has become woven into an important aspect of how we work. Companies out of necessity had to adjust on the fly to the pandemic and suddenly become experts in remote work capabilities and teleconferences. And to the chagrin of many, companies found they were just as productive at home, and more importantly, the majority of the workforce really liked it. As the pandemic concerns and risks faded, more than a few employers have rattled and made threats about bringing everyone back into the office, demanding they return to the mothership, and for things to revert to “normal” in terms of work environment. But that became more of an empty threat. Instead what we have seen is more of a negotiated settlement between employee and employer where you might at worst see a work week consisting of a few days in the office and the rest of the days work at home.

A big reason for that is, similar to our office dress attire example above, due to competition. Once again, those who wanted to return to a full work in office routine found that with employment red hot and more jobs available than workers they really weren’t in a position to demand much. And so, at least initially and for the immediate future, work from home seems pretty much embedded in our lives for now. That means a change in office space requirements.

The first question we need to ask is, “will this last?” It might simply be a question of who has the upper hand right now, employees or employers. At first employers were pretty public and loud about plans for bringing workers back. The bigger names who went public with those banks tended to be banks like JP Morgan. But over time that has kind of waned. It might be that at some point, many of the employers began to look around at the cost of leasing space or building out new office parks and realized that there was significant savings to be had by dropping square footage needs. If work efficiency could be maintained, why would you need to pay for the extra space? Once this began to dawn on employers, the shift in exactly what or how much office space was needed or better yet, not needed, began to have dramatic effects on the commercial real estate market, and ultimately will affect CMBS.

According to Bloomberg, the average office usage is about 50% of pre-pandemic levels. Daily we see anecdotal evidence of large, headline companies stepping back from office property expansion. Amazon pausing construction on a second headquarters near Washington, according to Bloomberg. Facebook announcing it is reducing the amount of New York City office space it leases, terminating its lease at one building and consolidating its work force in another. And Twitter deciding to exit New York City and putting their current lease space up to be available to be subleased.

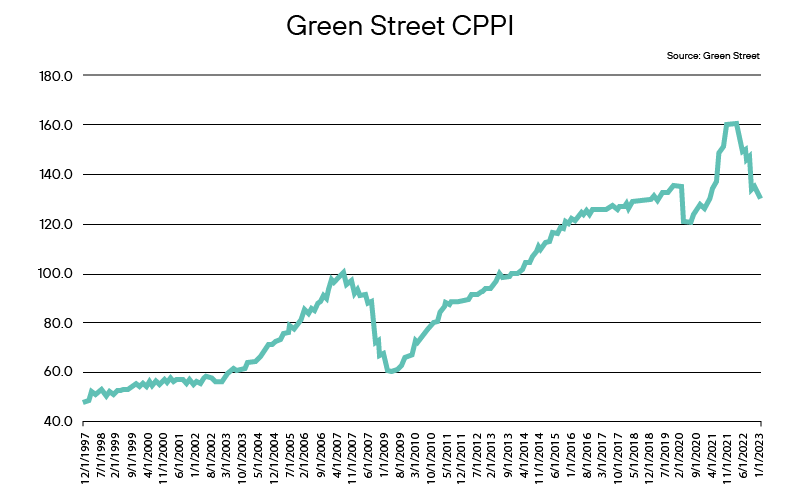

Worse, the value of commercial real estate itself is falling. According to Green Street’s Commercial Property Price Index (CPPI), which carries an office weighting of some 17.5%, overall commercial property values have fallen 15% over the past 12 months, and worse, office building values on a standalone basis have fallen 25%.

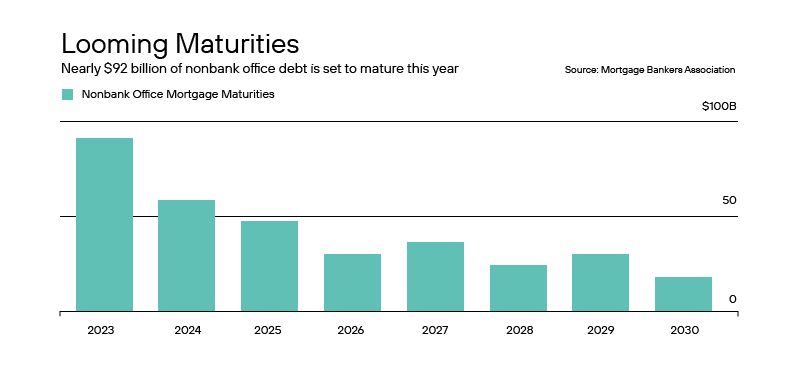

Additionally, what is looming ahead for the industry isn’t any more comforting. According to the Mortgage Bankers Association, some $92 billion of nonbank office debt is maturing in 2023. That is a formidable number, especially when you take into account that on a daily basis we are witness to more and more large institutional investors, in the face of soaring borrowing costs, simply defaulting on properties and moving on. In February, Columbia Property Trust (a PIMCO acquired asset manager) defaulted on $1.7 billion of mortgages, according to Bloomberg. Brookfield Corp., a well known property owner, defaulted on buildings in the Los Angeles area. Thus in the face of a high interest rate environment and looming maturities, and large asset managers and property managers suddenly unconcerned with the negative publicity of letting properties default, there is quite a bit of pressure building in the space.

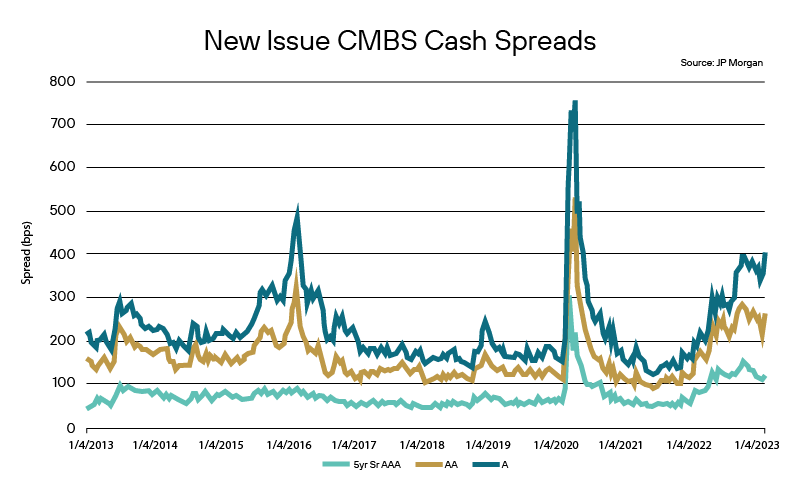

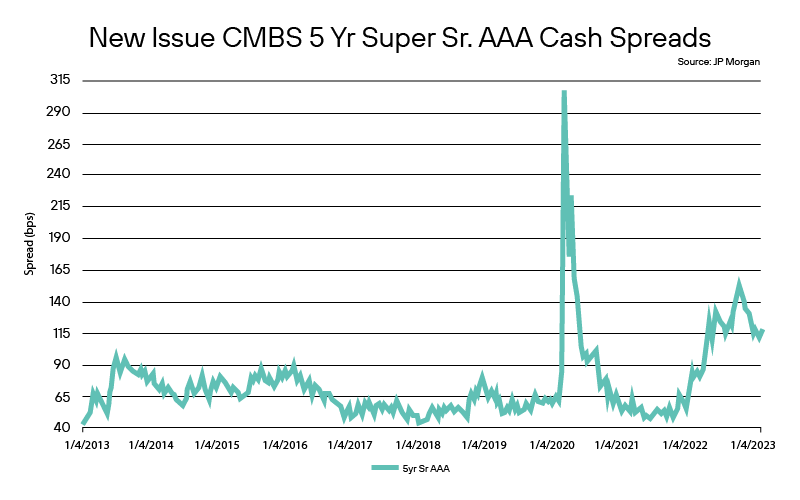

This has quite clearly had an impact on CMBS. Spreads across the credit stack continue to widen, unlike other ABS sectors where we have been witness to some spread tightening. New issue CMBS cash spreads to treasuries, according to JP Morgan, have widened out 3 bps in 5 year super-senior AAA, 13 bps in 10 year super senior AA, and 45 bps in single A in the last month, with the primary driver of this the concern revolving around office building exposures. Indeed, according to JP Morgan, vacancy rates and total availability rates for office space reached 12.5% and 16%, respectively, at February month-end, which are the highest readings since the Great Financial Crisis.

For the 5 year super senior AAA, this type of spread widening would be the second widest in the past 10 years, outside the spike witnessed at the beginning of the pandemic.

Quite clearly, we have seen a fundamental change to where we work, and that is sending a significant ripple through the office building sector. Recently we have heard of various “solutions” being proposed, with a primary one being a “repurpose” of some of these buildings. In some cases, suggestions to convert office space into say condos or housing options. But as we have discussed previously, it isn’t so simple. Major initial stumbling blocks, especially in large cities such as New York City, are the various zoning regulations in place. And even if one were to be more nimble than imagined and be able to navigate those waters, there is the cost of refurbishing or repurposing these buildings. This is especially daunting when one considers the high cost of financing which is already dampening even the refinancing of some of these loans coming due, and causing large investors to walk away. All of which doesn’t even include the amount of time it would take to accomplish the task.

What seems on the horizon are some serious issues around financing, and certainly we would expect fallout in the CMBS. Historically, CMBS at the AAA peg in the credit stack has been fairly resilient. Defaults at that level are not numerous, but that certainly doesn’t mean that damaging pricing on holdings can’t be seen (see above). However, there should be heightened credit concern at the lower levels of the credit stack, and most certainly at BBB and below, and depending on the concentration of office exposures in some deals, the single A and potentially AA tranches. However you look at it, the impact of how we have morphed in the work environment and where we work is certainly going to have an impact on the securities those exposures are concentrated in.

Commercial real estate is under duress and we would certainly expect CMBS to suffer some from the fallout. We have long avoided the sector. Initially our reservations had more to do with valuations and a concern from spread risk. Once the pandemic hit and post-pandemic, we became a bit wary of those deals that have high exposures to office and retail. We have concerns about the tail risk of the sector, and it seems that might have caught up to the market. CMBS is typically a less liquid sector, given the size and structural complexity of the deals and the investor base which tends to be populated with large buy and hold investors such as life insurers. We continue to avoid the sector, and prefer shorter more liquid paper, in the ABS sector.

Definition of Terms

Basis Points (bps) - refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Curvature - A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Mortgage-Backed Security (MBS) - A mortgage-backed security is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

Collateralized Loan Obligation (CLO) - A collateralized loan obligation is a single security backed by a pool of debt.

Commercial Real Estate Loan (CRE) - A mortgage secured by a lien on commercial property as opposed to residential property.

CRE CLO - The underlying assets of a CRE CLO are short-term floating rate loans collateralized by transitional properties.

Asset-Backed Security (ABS) - An asset-backed security is an investment security—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables

Option-Adjusted Spread (OAS) - The measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Enhanced Equipment Trust Certificate (EETC) - One form of equipment trust certificate that is issued and managed through special purpose vehicles known as pass-through trusts. These special purpose vehicles (SPEs) allow borrowers to aggregate multiple equipment purchases into one debt security

Real Estate Investment Trust (REIT) - A company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors.

London InterBank Offered Rate (LIBOR) - a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Secured Overnight Financing Rate (SOFR) - a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR).

Delta - the ratio that compares the change in the price of an asset, usually marketable securities, to the corresponding change in the price of its derivative.

Commercial Mortgage - Backed Security (CMBS) - fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Floating-Rate Note (FRN) - a bond with a variable interest rate that allows investors to benefit from rising interest rates.

Consumer Price Index (CPI) - a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Gross Domestic Product (GDP) - one of the most widely used measures of an economy's output or production. It is defined as the total value of goods and services produced within a country's borders in a specific time period—monthly, quarterly, or annually.

Perp - A perpetual bond, also known as a "consol bond" or "perp," is a fixed income security with no maturity date.

Nonfarm payrolls (NFPs) - the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications. This is measured by the federal Bureau of Labor Statistics (BLS), which surveys private and government entities throughout the U.S. about their payrolls.

Net Asset Value (NAV) - represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.

S&P 500 - The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

German DAX - The DAX—also known as the Deutscher Aktien Index or the GER40—is a stock index that represents 40 of the largest and most liquid German companies that trade on the Frankfurt Exchange. The prices used to calculate the DAX Index come through Xetra, an electronic trading system.

NASDAQ - The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.

MSCI EM Index - The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei - The Nikkei is short for Japan's Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Shanghai Composite - is a stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange.

Bloomberg U.S. Agg - The Bloomberg Aggregate Bond Index or "the Agg" is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

MOVE Index - The ICE BofA MOVE Index (MOVE) measures Treasury rate volatility through options pricing.

VIX Index - The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

Dow Jones Industrial Average - The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Hang Seng - The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

STOXX Europe 600 - The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Euro STOXX 50 - The EURO STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within eurozone nations.

CAC (France) - is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse).

Duration Risk - the name economists give to the risk associated with the sensitivity of a bond's price to a one percent change in interest rates.

Federal Open Market Committee (FOMC) - the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMO).

United States Treasury (UST) - the national treasury of the federal government of the United States where it serves as an executive department. The Treasury manages all of the money coming into the government and paid out by it.

High Yield (HY) - high-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Investment Grade (IG) - an investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Exchange Traded Fund (ETF) - an exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock.

Federal Family Education Loan Program (FFELP) - a program that worked with private lenders to provide education loans guaranteed by the federal government.

Business Development Program (BDC) - an organization that invests in small- and medium-sized companies as well as distressed companies.

Job Opening and Labor Turnover Survey (JOLTS) Report - is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

Sifma - The Securities Industry and Financial Markets Association (SIFMA) is a not-for-profit trade association that represents securities brokerage firms, investment banking institutions, and other investment firms.

Control #: 16629808-UFD-3/20/2023