“Luck is what happens when preparation meets opportunity.”

- Seneca

Time to indulge again. November always seems to end that way. That is if eating in one Thanksgiving sitting more than the entire Pilgrim population had for an entire month counts as indulging. I think it does. I would feel bad for the Pilgrims, but that is the benefit of time. There is the whole Thanksgiving food thing and the fact we are less likely to die from a common cold, but then again, we live in a world where I am told “Influencer” is a real profession, and I don’t think the Pilgrims had to deal with that nonsense. The problem, of course, about indulging is that in the moment, as you are doing so, you just don’t think about it. You just keep going. You are gonna pay for it later, of course, when you have to lay down on the couch like a wounded buffalo, but at the table, at the moment when thirds still seem like a good idea, you aren’t really thinking about what is coming after you put the fork down. You aren’t thinking much about what comes next.

We are now a month out from the end of the year. I gave thanks for that. I also still have a month not to feel guilty about the fact that I will not be buying my wife a new car with a bow on it, despite how many Lexus commercials I am forced to watch. But now is the time to consider what comes next. What is in front of us, and did we or did we not put the fork down in time?

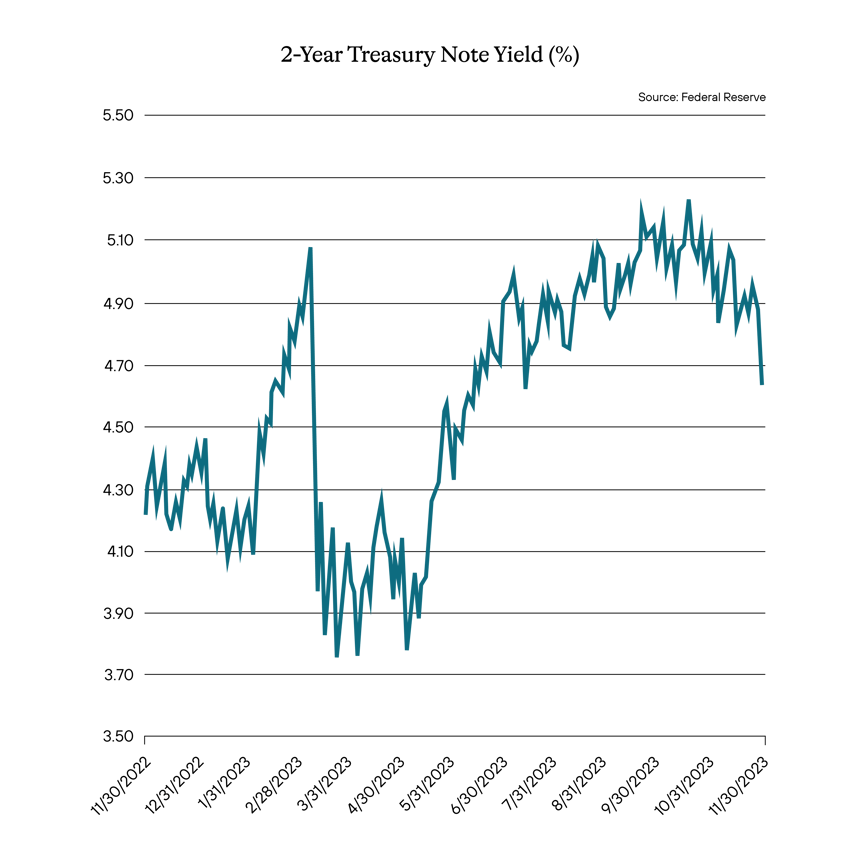

Over the past few weeks, we have witnessed quite a rate rally. In mid-October, the 2-year treasury hit 5.22% yield, a 52-week high. From that point to the end of November, it dropped over 50 bps, ending the month at 4.68%.

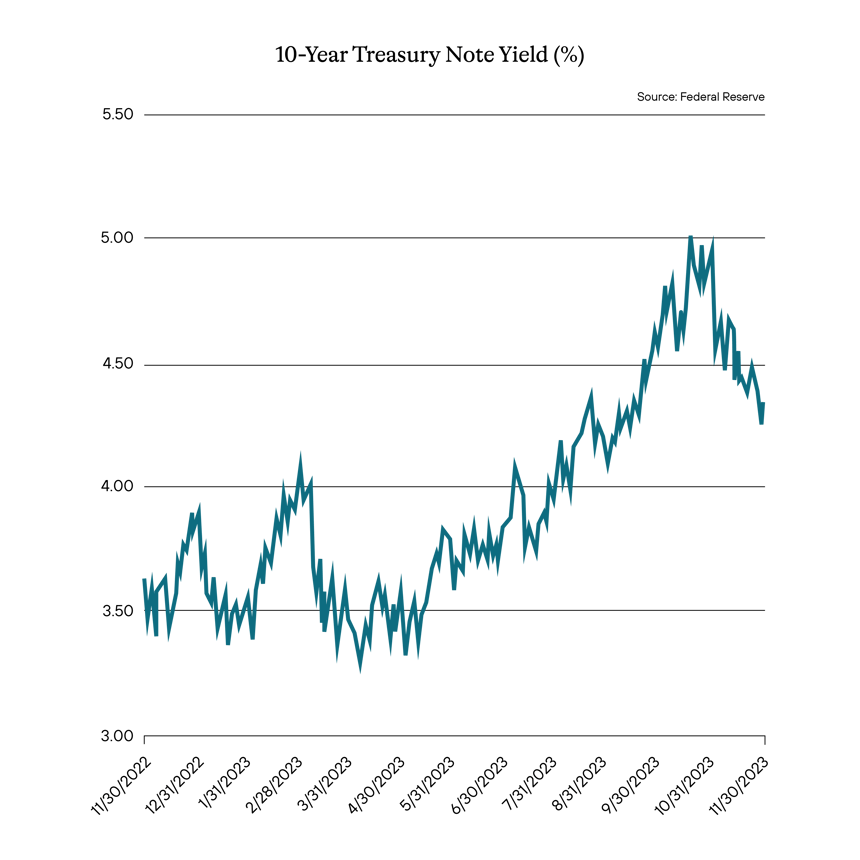

The 10-year treasury moved in a similar fashion. On October 19, 2023, the 10-year treasury hit a yield of 4.99%, but by the end of November, the yield on the note had hit 4.33%, a rally of over 60 bps.

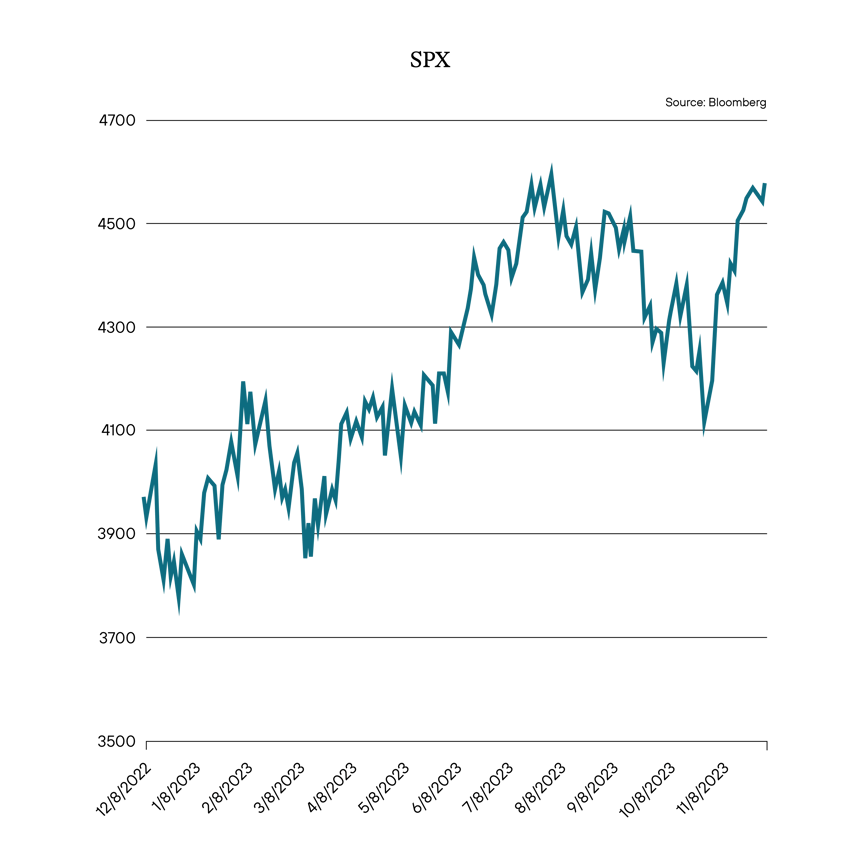

This obviously has been quite a moment for the bond market. With yields falling, asset values have recaptured a great deal of what had been lost over the past 6 months, and it seems like momentum is on its side. The move has also translated into benefitting risk assets. The S&P 500 has rallied quite a bit over the past few months as well, creating a late-year bull market in equities.

What seems to have driven this rally across all segments of the capital markets and risk assets, in general, has been the expectation the Fed is not just done hiking rates, and not even that the Fed is going to stay “higher for longer” as they have been pushing in their speeches lately. No, the majority of investors seem convinced the Fed is going to have to start cutting rates. A few months ago, there had been hope that they would cut rates by the end of the second quarter of 2024. That shifted a bit a few weeks ago, when expectations started to exhibit some group thought that we are talking about the end of the first quarter in 2024. And now, even better, days before the end of November, there was some optimism, ever so shy, that we would see some pressure on the Fed to cut as soon as early in the first quarter of 2024.

What has been pushing this narrative, this change of heart, with regards to Fed expectations, has been economic data that suggests that not only is inflation easing, but the job market is cooling. In other words, the economy is slowing down, and while recession may not be the ultimate landing spot, we are talking about a slowing economy. Great news, right?

Lots of enthusiasm over that, which strikes us as a bit odd.

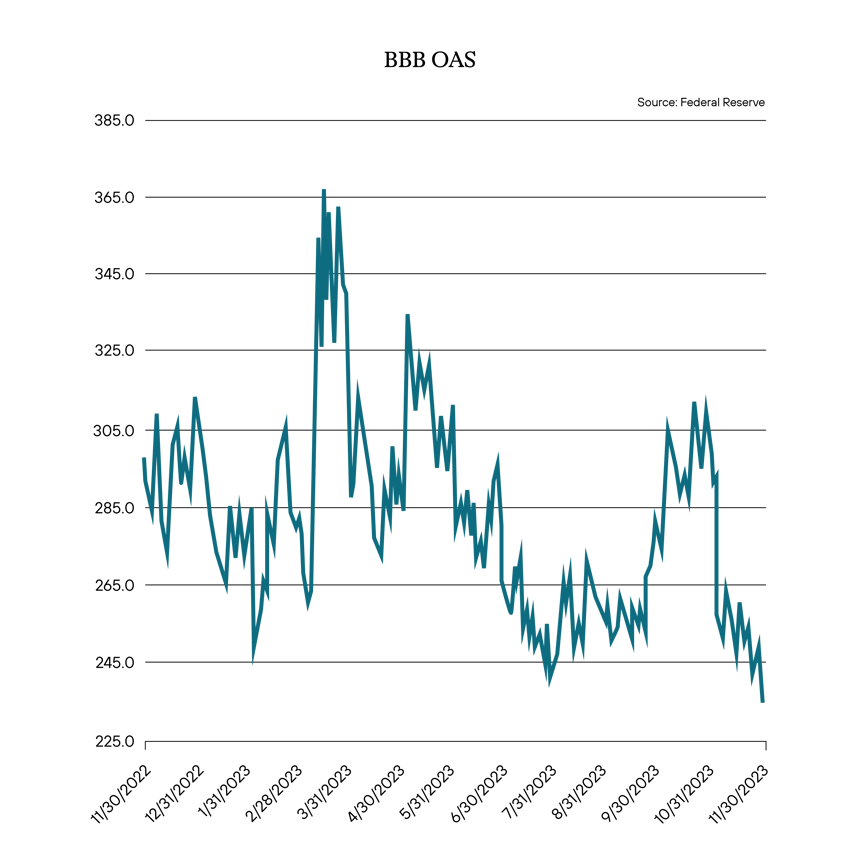

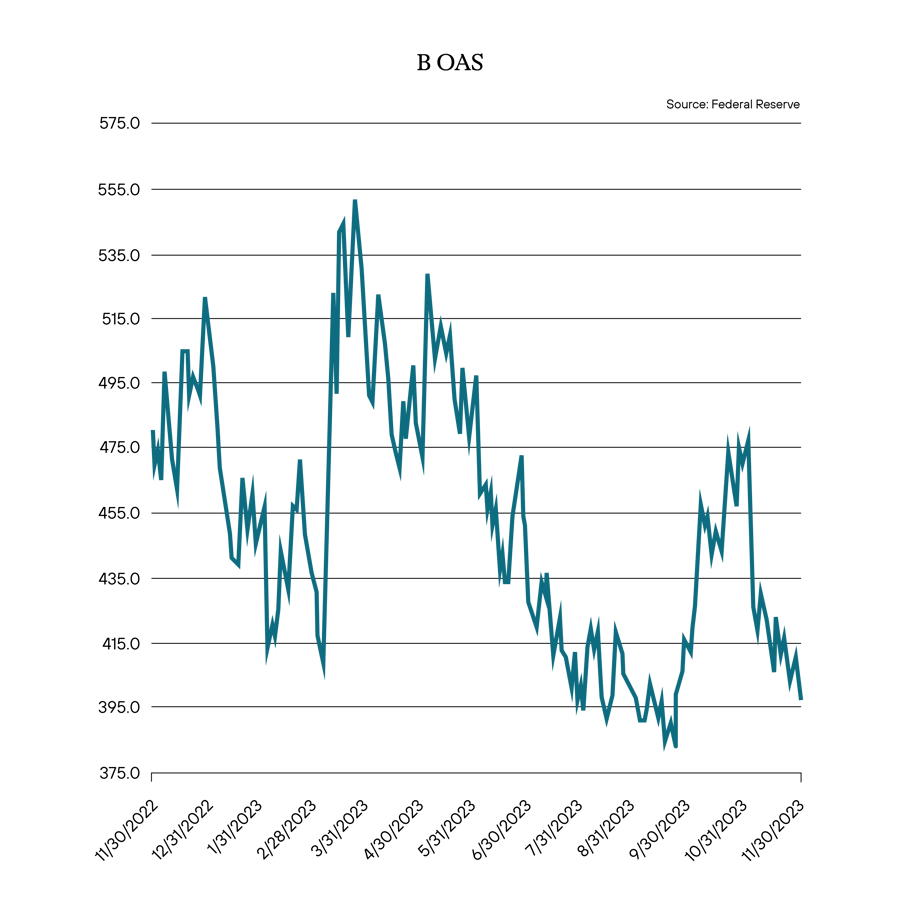

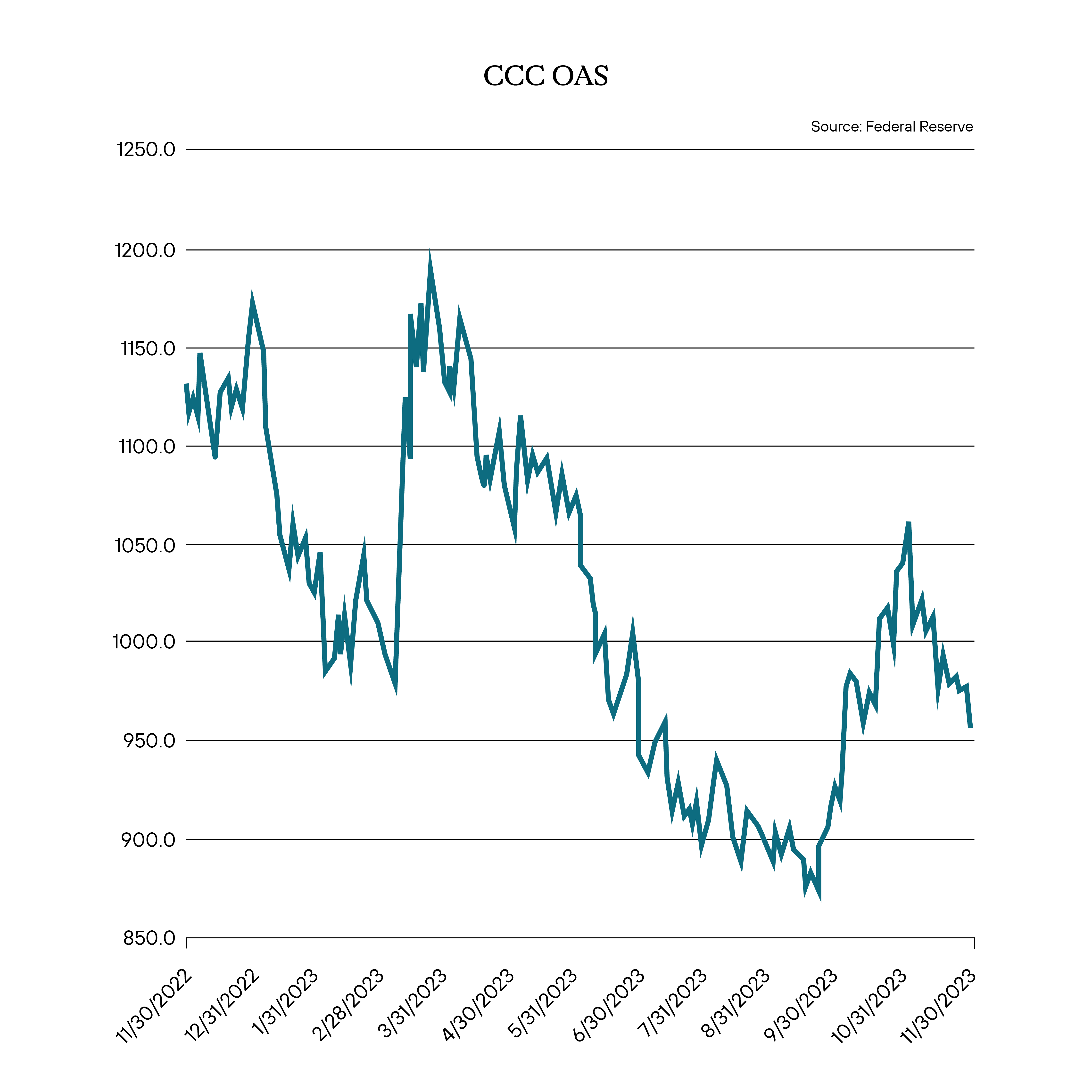

Because it hasn’t just been rate expectations that have driven this rally in fixed-income asset valuations. Credit spreads have been helping out as well. Indeed, what we are witnessing, into the teeth of this rally, during a time that expectations are shifting to the tune that the Fed will have to cut soon due to a slowing economy, is that credit spreads are….well….tightening. Across the board, whether it be BB, single B, or CCC corporates, credit spreads continue to grind tighter, and at the same time, rate expectations due to a slowing economy are rallying.

We certainly are seeing plenty of headlines with regard to big, well-known investors indicating that it is full steam ahead for risk assets. Indeed, we are inundated with headlines that large, sophisticated shops are raising capital to extend their credit risk or waving in risky assets as they feel the fear is overblown, which has the effect of encouraging others to indulge as well. Private credit, which we have discussed previously, is still raging. Blackstone, TPG, and other large, well-respected shops and a multitude of smaller, less-known investment firms continue to pile into private credit, raising money for new funds non-stop. How much? According to Axios, fundraising for private credit should surpass $200 billion this year, the third straight year it has topped that mark. So it doesn’t seem like that is slowing anytime soon. And Bloomberg recently published an article where KKR is aggressively buying up high-yielding debt as they feel the fear in the market about “…increased defaults and a breakdown in private lending sector is overblown.”

We are less willing to put a bow on it. Indeed, if rates are rallying due to the assumption that the economy is slowing, that would lead us to expect credit to see a downturn. But what seems less obvious is that we don’t quite know just yet how much damage having rates hiked to current levels actually did. That is, we don’t know how much of a lag there will be before evidence of that damage starts showing up in the data. The ultimate fallout, especially for corporations forced to refinance at these levels in the public markets or those who had outstanding floating rate debt, such as secured loans, with a variable rate structure, and thus have had to pay higher and higher debt service costs on those for an extended period, won’t be known for a while. Lastly, just what this means for individuals and how this might have changed or is currently impacting their ability to repay any sort of outstanding debt, credit card, or consumer loans.

But we are starting to get some hints.

There continues to be anecdotal evidence of the fallout. For instance, in the ABS market, we have now seen downgrades in marketplace lending deals (MPL), a relatively new ABS sector that hasn’t truly been through a down credit cycle, given its history started around 2016. MPL is based on unsecured consumer lending, and of late, there have been a series of downgrades in various deals. Higher-than-expected losses drove those downgrades. Or, as JPMorgan recently mentioned in their ABS research report and topics we have touched upon previously, “higher borrower defaults, driven by high inflation and declining borrower savings.” We are also seeing similar outcomes in certain newer vintage prime and non-prime auto ABS transactions as well.

We also see it on the corporate level. In fact, a piece of information that should probably cause a pause in all that money pumping into private credit is a recent Goldman Sachs research report. It states that we are witnessing the “pace of downgrades in the leveraged loan market accelerate given the swollen debt burdens for loan issuers.” According to Goldman Sachs, this is causing some rating pressure on the subordinate tranches of CLOs. Any way you look at it, it would seem to indicate that corporate credit is starting to crack, as we would expect at the lower end of the stack, and there is some uneasiness in consumer credit.

The last bit of interesting data? Bloomberg reported that the secured overnight financing rate, the repo market relied upon by banks, money market funds, and hedge funds, spiked some 6 bps at the end of November. While 6 bps might not seem alarming to some, it certainly is noteworthy. Movement in the short-term financing market is a canary in the coal mine, and when anomalies are seen, it typically is worth paying attention to. In fact, the last time we saw that type of spike was in September 2019, which, as the article points out, is when the Federal Reserve had to step in with significant….rate cuts.

We don’t expect a recession. We are not necessarily expecting a huge credit issue in the market. Instead, we are focused on pushing back from the table some. As mentioned, we do think the ultimate effects of the rate hikes haven’t been fully seen yet. How much of a lag there is is debatable. Nevertheless, we do expect further slowing in the economy. While some are using that as a means to celebrate the idea that the Fed will start cutting rates as well as the need to lock in higher yield with risky assets, we tend to take the more conservative viewpoint. We feel the tightening of credit spreads seems counterintuitive to what we would expect if this path continues evolving.

Yields are still significantly high, at least from a near-term historical standpoint. We prefer to be cautious here, focusing on taking the higher yields the market gives us at a safer credit perch. We prefer the up in credit trade and continue to focus on maintaining a high degree of liquidity.

Definition of Terms

Basis Points (bps) - refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Curvature - A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Mortgage-Backed Security (MBS) - A mortgage-backed security is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

Collateralized Loan Obligation (CLO) - A collateralized loan obligation is a single security backed by a pool of debt.

Commercial Real Estate Loan (CRE) - A mortgage secured by a lien on commercial property as opposed to residential property.

CRE CLO - The underlying assets of a CRE CLO are short-term floating rate loans collateralized by transitional properties.

Asset-Backed Security (ABS) - An asset-backed security is an investment security—a bond or note—which is collateralized by a pool of assets, such as loans, leases, credit card debt, royalties, or receivables.

Option-Adjusted Spread (OAS) - The measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option.

Enhanced Equipment Trust Certificate (EETC) - One form of equipment trust certificate that is issued and managed through special purpose vehicles known as pass-through trusts. These special purpose vehicles (SPEs) allow borrowers to aggregate multiple equipment purchases into one debt security

Real Estate Investment Trust (REIT) - A company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors.

London InterBank Offered Rate (LIBOR) - a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Secured Overnight Financing Rate (SOFR) - a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR).

Delta - the ratio that compares the change in the price of an asset, usually marketable securities, to the corresponding change in the price of its derivative.

Commercial Mortgage-Backed Security (CMBS) - fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Floating-Rate Note (FRN) - a bond with a variable interest rate that allows investors to benefit from rising interest rates.

Consumer Price Index (CPI) - a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Gross Domestic Product (GDP) - one of the most widely used measures of an economy's output or production. It is defined as the total value of goods and services produced within a country's borders in a specific time period—monthly, quarterly, or annually.

Perp - A perpetual bond, also known as a "consol bond" or "perp," is a fixed income security with no maturity date.

Nonfarm payrolls (NFPs) - the measure of the number of workers in the United States excluding farm workers and workers in a handful of other job classifications. This is measured by the federal Bureau of Labor Statistics (BLS), which surveys private and government entities throughout the U.S. about their payrolls.

Net Asset Value (NAV) - represents the net value of an entity and is calculated as the total value of the entity’s assets minus the total value of its liabilities.

S&P 500 - The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States.

German DAX - The DAX—also known as the Deutscher Aktien Index or the GER40—is a stock index that represents 40 of the largest and most liquid German companies that trade on the Frankfurt Exchange. The prices used to calculate the DAX Index come through Xetra, an electronic trading system.

NASDAQ - The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.

MSCI EM Index - The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei - The Nikkei is short for Japan's Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan's top 225 blue-chip companies traded on the Tokyo Stock Exchange.

Shanghai Composite - is a stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange.

Bloomberg U.S. Agg - The Bloomberg Aggregate Bond Index or "the Agg" is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

MOVE Index - The ICE BofA MOVE Index (MOVE) measures Treasury rate volatility through options pricing.

VIX Index - The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX).

Dow Jones Industrial Average - The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Hang Seng - The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong.

STOXX Europe 600 - The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone).

Euro STOXX 50 - The EURO STOXX 50 Index is a market capitalization weighted stock index of 50 large, blue-chip European companies operating within eurozone nations.

CAC (France) - is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse).

Duration Risk - the name economists give to the risk associated with the sensitivity of a bond's price to a one percent change in interest rates.

Federal Open Market Committee (FOMC) - the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMO).

United States Treasury (UST) - the national treasury of the federal government of the United States where it serves as an executive department. The Treasury manages all of the money coming into the government and paid out by it.

High Yield (HY) - high-yield bonds (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. High-yield bonds are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Investment Grade (IG) - an investment grade is a rating that signifies that a municipal or corporate bond presents a relatively low risk of default.

Exchange Traded Fund (ETF) - an exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same as a regular stock.

Federal Family Education Loan Program (FFELP) - a program that worked with private lenders to provide education loans guaranteed by the federal government.

Business Development Program (BDC) - an organization that invests in small- and medium-sized companies as well as distressed companies.

Job Opening and Labor Turnover Survey (JOLTS) Report - is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

Sifma - The Securities Industry and Financial Markets Association (SIFMA) is a not-for-profit trade association that represents securities brokerage firms, investment banking institutions, and other investment firms.

Duration - A calculation of the average life of a bond (or portfolio of bonds) that is a useful measure of the bond's price sensitivity to interest rate changes. The higher the duration number, the greater the risk and reward potential of the bond.

Home Equity Line of Credit (HELOC) - A home equity line of credit (HELOC) is a line of credit that uses the equity you have in your home as collateral.

Government-Sponsored Enterprise (GSE) - A government-sponsored enterprise (GSE) is a quasi-governmental entity established to enhance the flow of credit to specific sectors of the U.S. economy. Created by acts of Congress, these agencies—although they are privately held—provide public financial services.

Qualified Mortgage (QM) - A qualified mortgage is a mortgage that meets certain requirements for lender protection and secondary market trading under the Dodd-Frank Wall Street Reform and Consumer Protection Act, a significant piece of financial reform legislation passed in 2010.

Trust Preferred Securities (TruPS) - hybrid securities issued by large banks and bank holding companies (BHCs) included in regulatory tier 1 capital and whose dividend payments were tax deductible for the issuer.

Control #: 17690791-UFD 12/14/2023